Building a 3-Statement Model: A Step-by-Step Walkthrough

The 3-statement model is the backbone of financial analysis, linking the income statement, balance sheet, and cash flow statement into a dynamic, forward-looking tool.

In this guide, we’ll walk through the process of building a 3-statement model.

Step 1: Input Historical Data

Objective: Establish a baseline using historical financials.

- Populate the template with historical data for all three statements.

- Key historical inputs:

- Income Statement: Revenue, COGS, operating expenses, depreciation, interest expense, and net income.

- Balance Sheet: Cash, accounts receivable, inventory, PP&E, accounts payable, debt, and equity.

- Cash Flow Statement: Historical operating, investing, and financing cash flows.

Why This Matters: Historical trends (e.g., revenue growth, margin stability) inform future assumptions.

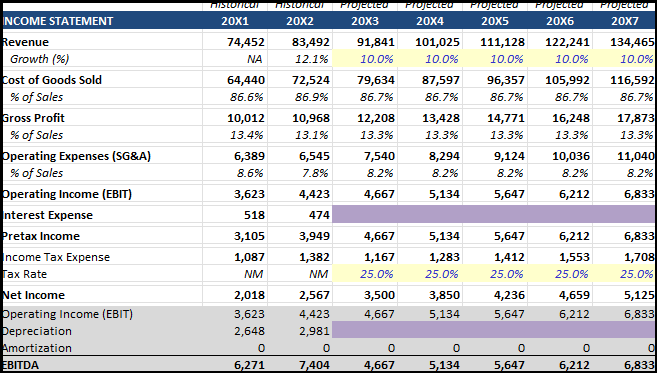

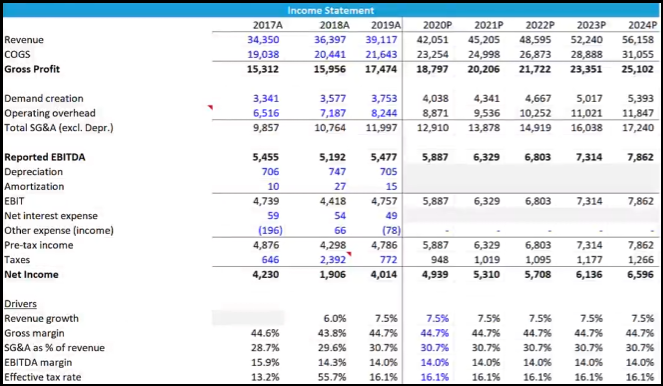

Step 2: Project the Income Statement

Objective: Forecast profitability and link key drivers.

- Revenue: Project using historical growth rates or management guidance.

- COGS & Operating Expenses: Tie to revenue percentages (e.g., % of sales using the average of the last 2 years).

- Purple-Shaded Items:

- Interest Expense: Calculated later in the Debt Schedule (leave blank for now).

- Depreciation: Derived from the PP&E Schedule (link after building supporting schedules).

Key Tip: Use consistent tax rates (e.g., 25%) for pretax income.

Step 3: Build the Balance Sheet

Objective: Assets = Liabilities + Equity

- Current Assets:

- Accounts Receivable: Use Debtor Days = (AR / Revenue) × 365 – use the Avg of the last 2 years or create a working capital schedule.

- Inventory: Use Inventory Days = (Inventory / COGS) × 365 – use the Avg of the last 2 years or create a working capital schedule.

- Cash: Purple-shaded - calculated later in the cash flow statement.

- Fixed Assets:

- PP&E, Net: Purple-shaded - linked to the PP&E Schedule.

- Liabilities & Equity:

- Line of Credit and Long-Term Debt: Purple-shaded - calculated in the Debt Schedule.

- Accounts Payables: Use Creditor Days = (AP / COGS) × 365 – use the Avg of the last 2 years or create a working capital schedule.

- Retained Earnings: Prior retained earnings + current net income (from income statement).

Step 4: Project the Cash Flow Statement

Objective: Reconcile cash movements and link to balance sheet cash.

- Operating Activities:

- Start with Net Income (from income statement).

- Add Back Non-Cash Items:

- Depreciation: Purple-shaded (link to PP&E Schedule).

- Adjust for Working Capital:

- Calculate changes in AR, inventory, and AP from balance sheet.

- Asset = Opening Balance - Closing Balance.

- Liability = Closing Balance - Opening Balance.

- Calculate changes in AR, inventory, and AP from balance sheet.

- Investing Activities:

- Capital Expenditures (CapEx): Purple-shaded (link to PP&E Schedule).

- Financing Activities:

- Line of Credit and Long-Term Debt: Purple-shaded (link to Debt Schedule).

- Ending Cash Balance: Ending Cash = Beginning Cash + Net Cash Flow (Operating + Investing + Financing). Link to the cash balance on the balance sheet.

Step 5: Build Supporting Schedules

Objective: Calculate purple-shaded items to finalize the model.

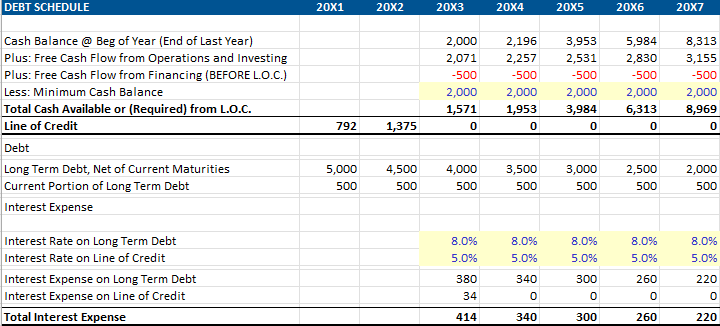

Debt Schedule

- Line of Credit (Revolver): Acts as a plug to cover cash shortfalls. LOC = MAX(0, Opening LOC - Cash Available)

- Interest Expense: Interest = (Avg Debt Balance × Interest Rate) + (Avg Line of Credit Balance × LOC Rate)

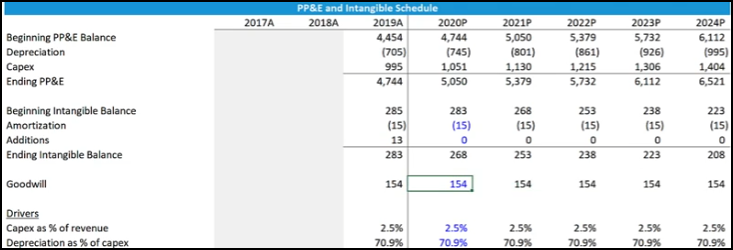

PP&E Schedule

- CapEx: Forecast based on growth or maintenance needs (e.g., % of revenue).

- Depreciation: Use straight-line or % of revenue method (avg of last 2 years).

- PP&E Roll-Forward: Ending PP&E = Beginning PP&E + CapEx - Depreciation.

How It All Connects:

- The Debt Schedule feeds interest expense to the income statement and debt balances to the balance sheet (Enable iterative calculation).

- The PP&E Schedule feeds depreciation to the income statement and PP&E to the balance sheet.

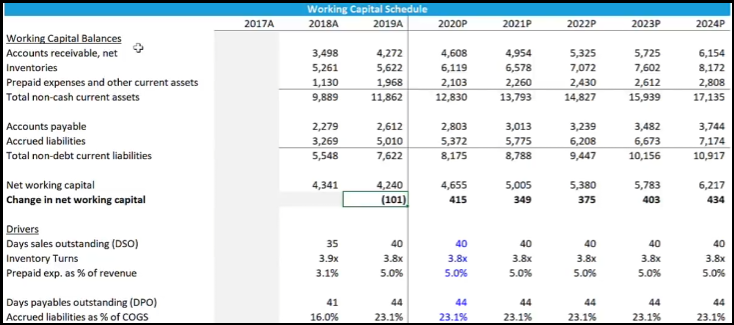

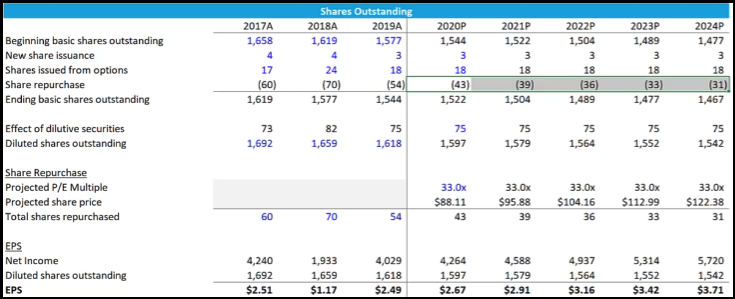

Working Capital Schedule - Example

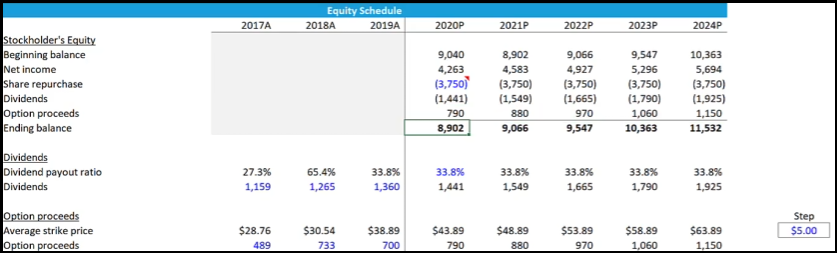

Equity Schedule - Example

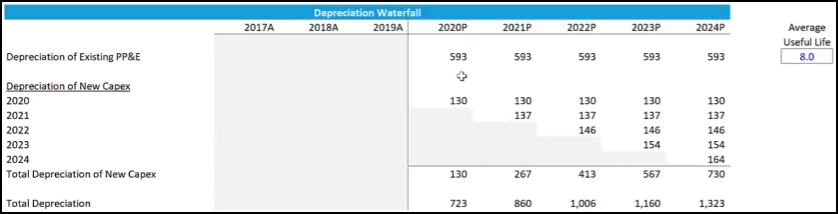

Depreciation Waterfall - Example

Step 6: Final Balancing & Formatting

- Check the Balance Sheet: Ensure Assets = Liabilities + Equity for all years.

- Formatting: Remove grid lines, and cell backgrounds for constants.

Why This Structure Works

- Top-Down Logic: Revenue drives the income statement, which feeds into retained earnings and cash flow.

- Dynamic Links: Changes in assumptions (e.g., slower growth) cascade through all statements.

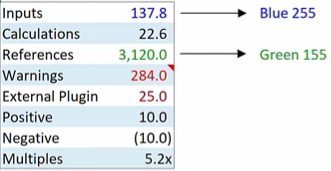

Excel Cell Highlighting Guide

- 🟨 Yellow Background + 🔵 Blue Text (0,0,255)

- Purpose: Indicates constant values or manual inputs (values entered directly by user).

- Examples:

- Fixed assumptions (e.g., tax rate = 25%).

- Hardcoded constants that don’t pull from other sheets or formulas.

- 🟪 Purple Background

- Purpose: Highlights cells which will be calculated from supporting schedules.

- Examples:

- Depreciation pulled from PP&E schedule.

- Interest calculated in Debt schedule

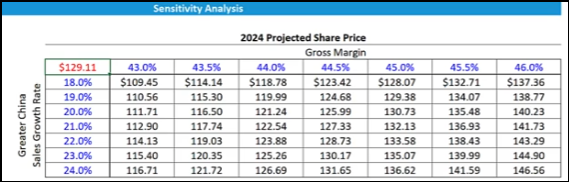

Advanced: Sensitivity Analysis

This is achieved using Data - What-if Analysis in Excel.

The example below is displaying the impact of gross margin changes and a revenue category growth rate changing on the projected share price.

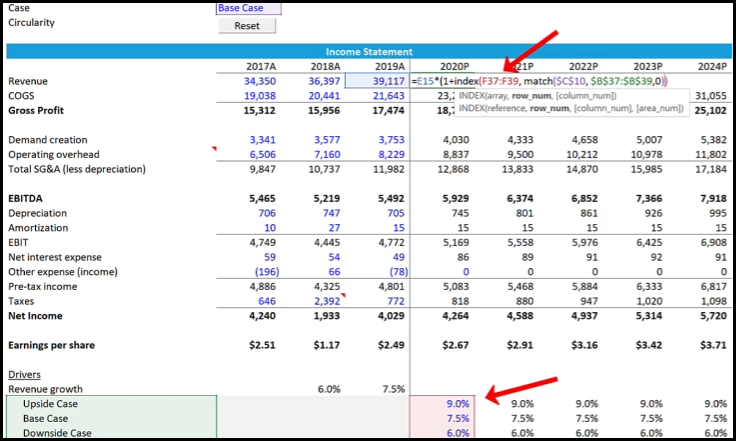

Advanced: Scenario Analysis

- Create a base list for users: Data - Data Validation - Allow List (Upside case, Base case, or Downside case).

- Modify the revenue growth rate to Index Match (see formula below) for switching the revenue growth rate based on the case selected; Upside case, Base case, or Downside case.

Conclusion

Building a 3-statement model is a systematic process of linking assumptions, schedules, and checks.

By following this step-by-step approach—and leaning on supporting schedules for complex calculations—you’ll create a robust model that answers critical questions about liquidity, profitability, and growth.

Next: Learn about The Discounted Cash Flow Model: https://www.myfinanceprocess.com/the-discounted-cash-flow-model/