Claude in Excel: The Future of Financial Strategy

For more than thirty years, the spreadsheet has been the most important piece of intellectual infrastructure in finance.

Every budget, valuation, forecast, acquisition model, restructuring plan, and board deck ultimately resolves to a grid of cells in Microsoft Excel. Despite waves of new BI tools, ERPs, and analytics platforms, Excel remains the final common language of financial truth.

Yet Excel has always carried a quiet limitation.

It scales calculation far better than it scales reasoning.

The integration of Claude, developed by Anthropic, directly into Excel represents the first credible attempt to close that gap. Not by replacing spreadsheets, but by transforming what spreadsheets are.

This post presents a comprehensive thesis for finance and strategy professionals on Claude in Excel as a new cognitive architecture: how it works, why it matters, where the real alpha comes from, how it changes organizational behavior, and what finance leaders must do to wield it responsibly.

Part I — The Historical Constraint: Why Finance Thinking Plateaued

Excel’s Silent Tradeoff

Excel’s genius has always been abstraction.

By allowing humans to express financial logic symbolically, =Revenue * Margin it removed the friction of arithmetic. But in doing so, it created a subtle bottleneck: logic construction became the scarce resource.

As models grew:

- formulas nested inside formulas

- assumptions embedded invisibly

- dependencies stretched across dozens of tabs

The spreadsheet became harder to understand than to calculate.

Finance adapted by narrowing scope:

- fewer scenarios

- simplified assumptions

- linear projections

- static planning cycles

Not because deeper analysis lacked value - but because the cognitive cost of building and maintaining it was too high.

Determinism Without Understanding

Traditional Excel models are deterministic systems:

- Given the same inputs, they always produce the same outputs

- Errors are consistent, repeatable, and often invisible

This creates a dangerous illusion of certainty.

A model can be internally consistent and externally wrong - because the assumptions driving it were never surfaced, challenged, or even noticed.

Historically, finance has compensated with:

- reviews

- checks

- reconciliations

- institutional memory

But these are human overlays on a system that does not explain itself.

Claude changes that.

Part II — The Cognitive Grid: A New Spreadsheet Architecture

What Claude in Excel Actually Adds

Claude does not replace Excel’s calculation engine. That distinction is critical.

Instead, Claude introduces a semantic and reasoning layer that can:

- read formulas and values across the workbook

- infer structure and intent

- trace dependencies end-to-end

- explain logic in natural language

- surface implicit assumptions

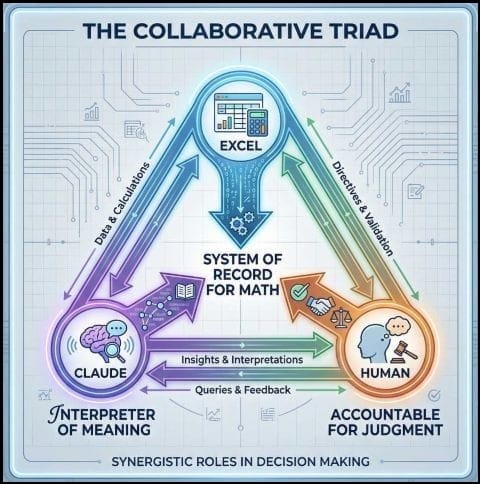

This fusion creates what we’ll call the Cognitive Grid:

- A spreadsheet environment where numerical determinism and contextual reasoning coexist.

In the Cognitive Grid:

- Excel remains the system of record for math

- Claude becomes the interpreter of meaning

- Humans remain accountable for judgment

This triad is the foundation of safe, scalable AI in finance.

State Awareness: Why This Is Not Just Another Copilot

The most important technical capability Claude brings is state awareness.

Unlike traditional assistants that operate on isolated prompts, Claude ingests the state of the workbook:

- cell values

- formulas

- tab relationships

- hidden assumptions

- metadata

This allows it to reason holistically.

For example:

- A 10% increase in marketing spend drives higher revenue but results in a Q3 cash shortfall due to working capital timing.

This is not a calculation.

It is an interpretation of a system.

That distinction is everything.

Part III — Why Claude Changes the Economics of Strategy

The Collapse of Second-Order Costs

Historically, finance teams focused on first-order outputs:

- revenue

- EBITDA

- free cash flow

Second-order effects were often ignored:

- behavioral responses

- timing mismatches

- feedback loops

- balance sheet stress

Why? Because modeling them was expensive.

Claude collapses that cost.

When a reasoning engine can:

- generate first-draft logic

- trace downstream effects

- explain consequences on demand

…then deeper thinking becomes economically viable.

Strategic consequence:

Teams that model second-order effects routinely will outperform teams that rely on linear narratives - even if both use the same data.

Excel Becomes a Strategy Simulator, Not a Forecasting Tool

Most financial models pretend to predict the future.

In reality, they encode arguments about how the world works.

Claude makes this explicit.

With Claude:

- forecasts become conditional statements

- scenarios become competing worldviews

- models become hypothesis containers

Instead of asking:

- Is this forecast correct?

High-performing teams ask:

- Under which assumptions is this forecast correct - and how fragile are those assumptions?

This transforms Excel into a strategy simulation engine.

Part IV — Use Cases for Claude in Excel

1. Model Intelligence & Spreadsheet Comprehension

(The foundational capability everything else depends on)

Purpose

Make any spreadsheet — no matter how large, old, or messy — understandable on demand.

Traditional constraint

Legacy models accumulate over years:

- undocumented assumptions

- logic split across tabs

- circular references understood by only one person

Understanding them requires:

- walkthrough meetings

- tribal knowledge

- don’t touch that cell folklore

This creates key-person risk and slows decision-making.

What Claude changes

Claude reconstructs the mental model behind the spreadsheet:

- how the model is structured

- what each section is trying to do

- where assumptions live

- how changes propagate

The spreadsheet becomes self-explaining.

How elite teams use it

- First step in every major analysis

- Mandatory for inherited models

- Used before board reviews and audits

- Embedded into onboarding playbooks

Example prompts

Basic comprehension

“Explain what this workbook is doing overall. Identify inputs, calculations, and outputs.”

Driver clarity

“Identify the top driver assumptions in this model and explain their economic meaning.”

Propagation tracing

“If this input changes, trace the downstream impact step by step to the final outputs.”

Structural risk

“Which parts of this model are hardest to audit or most fragile, and why?”

2. Driver-Based Planning & Forecast Architecture

(Where planning stops being cosmetic)

Purpose

Force clarity around why performance changes, not just how much.

Traditional constraint

Most forecasts rely on:

- top-down growth rates

- blended margin assumptions

- opaque ‘plug’ logic

This hides:

- causal drivers

- operational tradeoffs

- disagreement about strategy

What Claude changes

Claude makes driver explicitness cheap:

- decomposes revenue (price, volume, mix, churn, expansion)

- separates assumptions from mechanics

- forces consistency across statements

Planning becomes a structured debate, not a spreadsheet exercise.

How elite teams use it

- Driver libraries reused across cycles

- Scenarios defined by logic, not numbers

- Planning meetings centered on assumptions, not outputs

Example prompts

Architecture design

“Design a driver-based revenue and margin model appropriate for this business.”

Assumption hygiene

“Which drivers should be explicit vs implicit, and why?”

Scenario logic

“Define how Base, Upside, and Downside scenarios differ structurally — not just numerically.”

Sensitivity intelligence

“Rank drivers by impact on cash flow volatility, not just EBITDA.”

3. Scenario Design & Second-Order Effect Modeling

(Where most strategic mistakes are made)

Purpose

Understand chains of causality, not isolated sensitivities.

Traditional constraint

Excel makes first-order analysis easy:

- change one input

- see one output

Second-order effects require:

- complex rewiring

- manual iteration

- deep model familiarity

They’re often skipped.

What Claude changes

Claude reasons across:

- revenue → operations → balance sheet

- timing mismatches

- behavioral responses

Second-order analysis becomes default, not exceptional.

How elite teams use it

- Stress-testing strategic initiatives

- Liquidity planning under uncertainty

- Identifying failure modes before they happen

Example prompts

Causal chains

“If we cut price by 5%, model second-order impacts on churn, working capital, and cash timing.”

Constraint detection

“Under stress, which operational or financial constraints bind first?”

Hidden risks

“What risks emerge only after two or three steps of causality?”

Scenario fragility

“Which assumptions, if wrong, would cause this scenario to fail fastest?”

4. Variance Analysis as Organizational Learning

(Not just month-end reporting)

Purpose

Turn variance analysis into a closed-loop learning system.

Traditional constraint

Variance decks often:

- explain outcomes ex post

- lack causal clarity

- fail to improve future forecasts

They describe history without informing strategy.

What Claude changes

Claude connects:

- variances → drivers → assumptions → decisions

Variance analysis becomes feedback, not commentary.

How elite teams use it

- Monthly assumption recalibration

- Forecast bias detection

- Performance attribution at decision level

Example prompts

Driver attribution

“Explain this variance in terms of price, volume, mix, and timing.”

Structural diagnosis

“Which variances represent persistent change vs noise?”

Assumption correction

“Which planning assumptions were most wrong and why?”

Forward linkage

“How should next quarter’s forecast logic change based on this variance?”

5. Unstructured → Structured Strategic Intelligence

(Where strategy and finance finally merge)

Purpose

Quantify qualitative insight and link it to financial outcomes.

Traditional constraint

Strategy lives in:

- decks

- memos

- transcripts

Finance lives in:

- spreadsheets

The two rarely meet cleanly.

What Claude changes

Claude converts text into model-ready structure:

- themes

- sentiment

- frequency

- implied financial impact

Narrative becomes numerically testable.

How elite teams use it

- Customer-driven forecasting

- Regulatory risk modeling

- Competitive intelligence integration

Example prompts

Theme extraction

“Extract dominant themes from this text and quantify frequency and sentiment.”

Financial linkage

“Which themes imply revenue or margin risk, and through which drivers?”

Scenario translation

“Translate these qualitative risks into modeling assumptions.”

Strategic prioritization

“Which qualitative signals warrant immediate financial action?”

6. Continuous Planning & High-Frequency Strategy

(Where compounding advantage emerges)

Purpose

Adapt strategy continuously, not episodically.

Traditional constraint

Planning cycles lag reality due to:

- modeling cost

- organizational inertia

What Claude changes

Claude makes:

- scenario generation cheap

- assumption revision fast

- iteration continuous

How elite teams use it

- Rolling forecasts

- Rapid response to shocks

- Ongoing strategy recalibration

Example prompts

Assumption review

“Which assumptions are most likely outdated given recent results?”

Rapid downside

“Create a downside scenario reflecting current conditions.”

Action triggers

“If performance deteriorates by X, what actions should we take and when?”

Part V — The Real Alpha: Behavioral and Organizational Effects

High-Frequency Strategy

When scenario creation is cheap:

- planning cycles shorten

- assumptions are revisited continuously

- decisions adapt faster

Claude does not make decisions for you.

It makes changing your mind cheaper.

In volatile environments, that is a decisive advantage.

The End of Zombie Work

Claude’s highest ROI often comes from eliminating work that persists only because automation was previously brittle:

- rebuilding the same model every cycle

- rewriting the same commentary every month

- re-explaining legacy spreadsheets

This frees capacity.

But capacity only compounds if reinvested into better thinking, not just faster closes.

The Talent Inversion

Before Claude, scarcity lived in:

- Excel mechanics

- formula wizardry

After Claude, scarcity shifts to:

- model architecture

- assumption design

- scenario logic

- governance and validation

Typing skill depreciates.

Judgment appreciates.

The finance teams that retrain analysts to manage AI reasoning, not compete with it, will dominate.

Part VI — Operating Models and Governance

The Four-Layer Cognitive Grid Operating Model

High-performing teams converge on four layers:

- Deterministic Core

Excel formulas, Python, checks, reconciliations - Semantic Interpretation

Claude explains structure and dependencies - Scenario & Reasoning Layer

Second-order effects, stress tests, narratives - Governance & Judgment

Human approval, auditability, accountability

Skipping any layer creates fragility.

Risk, Hallucination, and Why Controls Improve

Claude introduces probabilistic risk - but it also reduces many deterministic risks:

- hidden hardcodes

- undocumented logic

- broken dependencies

The safest architecture is a triad:

- deterministic math

- probabilistic reasoning

- human judgment

This is stronger than any component alone.

Part VII — The Meta Shift

Thinking Becomes the Bottleneck Again

For decades, finance was constrained by:

- manual effort

- model construction

- data wrangling

Claude removes much of that friction.

What remains scarce:

- clarity of intent

- quality of questions

- strategic imagination

Claude in Excel does not automate finance.

It raises the minimum viable level of thinking required to compete.

The Strategic Mandate

Claude in Excel is a restructuring of the financial analytical stack.

By embedding a reasoning engine inside the spreadsheet:

- assumptions become visible

- iteration accelerates

- strategy and finance converge

Excel remains the canvas.

But the cognitive burden of reasoning is shifting.

The finance teams that master the Cognitive Grid will not just move faster.

They will think better, adapt sooner, and decide with greater clarity.

The question is no longer whether AI belongs in finance.

The question is:

Who will operationalize reasoning first - and compound the advantage?

FAQs: Claude in Excel

What is Claude in Excel?

Claude in Excel is the integration of the Claude large language model—developed by Anthropic—into Microsoft Excel.

Unlike traditional Excel automation tools, Claude does not just execute formulas. It reads, interprets, and reasons about the structure of a spreadsheet, including:

- formulas and values

- relationships across tabs

- implicit assumptions

- downstream effects of changes

In practice, Claude acts as a reasoning layer on top of Excel’s calculation engine.

Is Claude in Excel replacing Excel formulas or VBA?

No. Claude does not replace Excel’s deterministic calculation layer.

Best-practice usage looks like this:

- Claude writes or explains formulas

- Excel executes the math

- Humans review, approve, and validate

This separation is critical in finance. Deterministic engines (Excel, Python) remain responsible for calculation accuracy. Claude is responsible for logic construction, explanation, and insight generation.

How is Claude in Excel different from Microsoft Copilot?

This is a common question for enterprise finance teams.

Microsoft Copilot is deeply integrated into the Microsoft ecosystem and excels at:

- document drafting

- surface-level analysis

- workflow assistance across Office tools

Claude’s advantage in finance lies elsewhere:

- deeper multi-tab reasoning

- stronger logic tracing and explanation

- better handling of large, complex financial models

- clearer surfacing of assumptions and dependencies

In short:

- Copilot optimizes workflow convenience

- Claude optimizes financial reasoning depth

Many advanced teams evaluate both.

Can Claude handle large, complex financial models?

Yes - this is one of its core strengths.

Claude models are designed to operate with very large context windows, allowing them to reason across:

- multi-tab workbooks

- full three-statement models

- DCFs with sensitivities

- working capital schedules

- scenario frameworks

This allows Claude to trace a change from an input assumption through intermediate calculations to final outputs, something traditional Excel auditing tools struggle to do holistically.

Can Claude explain why a number changed, not just that it changed?

Yes, and this is one of the highest-value finance use cases.

Claude can:

- attribute variances to drivers

- distinguish structural vs one-time effects

- explain second-order impacts

- generate management-ready commentary

This turns variance analysis from descriptive reporting into causal reasoning, which is far more valuable for decision-making.

Is Claude accurate enough for financial decision-making?

Claude is not a calculator - it is a probabilistic reasoning system.

That distinction matters.

Claude is extremely effective at:

- generating logic

- explaining models

- surfacing risks and assumptions

- proposing scenarios

But best practice in finance is:

- Claude proposes

- deterministic tools compute

- humans approve

When used this way, Claude often reduces overall model risk by catching issues humans miss (hardcodes, inconsistent ranges, undocumented assumptions).

How does Claude impact FP&A and financial planning workflows?

Claude materially changes FP&A economics by:

- making scenario analysis cheap

- accelerating forecast iteration

- reducing manual rebuilds

- improving narrative quality

The biggest shift is cultural:

- FP&A moves from static planning cycles

- to continuous, high-frequency scenario evaluation

This is especially valuable in volatile environments.

Will Claude reduce the need for finance staff?

No - but it changes which skills matter.

Claude reduces demand for:

- manual spreadsheet construction

- repetitive reporting

- mechanical formatting

It increases demand for:

- model design

- assumption framing

- scenario logic

- governance and validation

Typing skill depreciates.

Judgment and system thinking appreciate.

What types of finance teams benefit most from Claude in Excel?

Claude delivers the most value where:

- models are complex

- decisions are high-stakes

- assumptions matter more than mechanics

This includes:

- FP&A

- corporate strategy

- M&A / corp dev

- private equity

- investment research

- CFO offices

The larger and more interconnected the model, the higher the payoff.

What is the long-term implication for finance as a profession?

The spreadsheet is not disappearing.

It is evolving - from a static calculator into a cognitive workspace.

Claude in Excel signals a future where:

- finance moves faster

- strategy becomes more testable

- reasoning becomes explicit

- assumptions are harder to hide

The teams that adapt early will not just be more efficient.

They will make better decisions.