Dividend Recaps Explained: What Investors Gain (and Companies Risk)

What is Dividend Recapitalization?

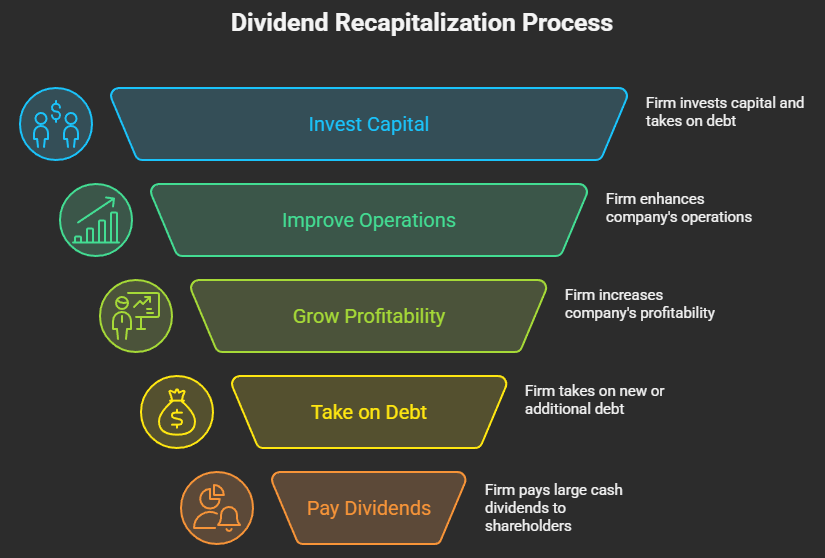

Imagine a private equity firm acquires a company, investing a significant amount of capital and taking on debt to do so. Their goal is to improve the company's operations, grow its profitability, and eventually sell it for a substantial return.

A dividend recapitalization occurs when a company, under private equity ownership, takes on new or additional debt and uses the proceeds to pay a large cash dividend to its shareholders – the LPs.

Essentially, it's a way for investors to recoup some of its initial investment by taking on more debt, before the eventual sale of the company.

Example: How Does Private Equity Use Dividend Recaps?

The Target Company: GrowthCo Analytics

Private Equity Firm: Apex Private Equity

- Initial Acquisition: In 2022, Apex Private Equity acquires GrowthCo Analytics, a rapidly expanding data analytics firm, for $500 million. The capital structure is $200 million of equity and $300 million in debt.

- Success and Growth: Over the next two years, Apex Private Equity works closely with GrowthCo's management. They streamline operations, invest in new product development, and expand into new markets. As a result, GrowthCo's revenue and profitability surge.

- The Dividend Recap Opportunity: By mid-2025, GrowthCo is performing exceptionally well. Its strong cash flow and reduced leverage (relative to its increased EBITDA) make it an attractive candidate for further borrowing. Apex Private Equity sees an opportunity to return capital to its LPs.

- Execution: Apex arranges for GrowthCo to take on an additional $150 million in new debt. The proceeds from this new debt are then paid out as a $150 million dividend directly to Apex Private Equity.

- The Outcome: Apex has now effectively recovered $150 million of its initial $200 million equity investment, while still owning GrowthCo Analytics, which continues to operate and generate strong cash flow. They can now return this capital to their investors, demonstrating an early win.

Why Do Private Equity Firms Do This?

Several motivations drive private equity firms to pursue dividend recaps:

- Early Return of Capital to Limited Partners (LPs): This is a primary driver. By returning capital earlier, private equity firms can demonstrate performance to their LPs, potentially enhancing their reputation and making it easier to raise future funds. LPs also appreciate the liquidity.

- De-Risking the Investment: By taking some cash off the table, the private equity firm reduces its remaining equity exposure in the company. If the company's future performance isn't as stellar as anticipated, their downside is mitigated.

- Capitalizing on Favorable Credit Markets: When interest rates are low and lenders are eager to provide financing, it's an opportune time for companies to take on additional debt. The prevailing economic environment, including central bank policies and investor appetite for risk, heavily influences the feasibility and attractiveness of dividend recaps.

- Funding Other Investments: The proceeds from a dividend recap can be redeployed into new investments, further optimizing the private equity fund's overall returns.

Who Benefits (and Who Might Not)?

While dividend recaps are primarily designed to benefit the private equity firm and its limited partners, it's worth considering the broader impact:

- Private Equity Firm & Limited Partners: As discussed, they get an early return on their investment, de-risking their position and enhancing fund performance.

- Lenders: Banks and other financial institutions that provide the new debt also benefit from interest payments and fees associated with arranging the loan.

- The Company Itself (Potentially Negatively): As we'll discuss, the company takes on increased debt, which can strain its finances and limit future flexibility.

The Potential Downsides and Risks

While dividend recaps can be lucrative, they are not without their risks:

- Increased Leverage and Debt Capacity: This is the most significant concern. The company essentially uses its future earning potential to pay out current dividends. Lenders assess the company's debt capacity – how much debt it can realistically service based on its cash flow and assets. Dividend recaps push this capacity. Often, these new loans might be covenant-lite loans, meaning they have fewer restrictions or financial hurdles that the company must meet, which can be attractive to the PE firm but adds more risk if performance falters.

- Impact on Future Growth: The additional debt burden could limit the company's ability to invest in future growth initiatives, such as R&D, capital expenditures, or acquisitions, as more cash flow is diverted to debt service.

- Reduced Financial Flexibility: With higher debt, the company has less flexibility to respond to unexpected events or seize new opportunities.

- Credit Rating Implications: Increased leverage can lead to a downgrade in the company's credit rating, potentially making future borrowing more expensive or difficult.

- Scrutiny from Stakeholders: Employees, suppliers, and customers might view a dividend recap negatively, perceiving that the private equity firm is prioritizing its own returns over the long-term health and stability of the company.

The Bottom Line

Dividend recapitalization is a sophisticated financial maneuver that allows private equity firms to realize early returns on their investments.

When executed judiciously on a strong, cash-generative company with robust financial health, and in a favorable credit environment, it can be a win-win for the private equity firm and its investors. However, like any financial strategy involving increased leverage, it comes with inherent risks, particularly for the operating company.