Effective Control Activities: Preventative and Detective

The ability to achieve objectives, safeguard assets, ensure data integrity, and maintain compliance is paramount. This is managed through a robust framework of internal controls and control activities – these are the essential actions taken to manage risks and ensure that processes operate as intended.

Think of control activities as the security system for an organization. They are the locks on the doors, the alarms that detect intruders, the surveillance cameras, and the trained guards who ensure everything runs smoothly and securely. Without them, an organization would be vulnerable to errors, fraud, inefficiency, and external threats.

What Are Control Activities?

Control activities are the policies and procedures that help ensure that management directives are carried out. They are actions taken by management or by an automated system to prevent or detect various risks, such as errors, fraud, non-compliance, or unauthorized access, that could threaten the organization.

These activities occur at all levels within an organization, across various functions, and can be manual or automated. They are not isolated events but rather integrated components of an organization's overall internal control system, designed to provide reasonable assurance that objectives will be achieved.

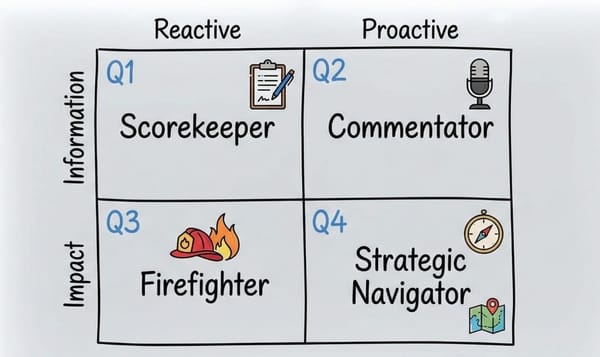

Preventative vs. Detective Controls

To build a truly resilient control environment, organizations strategically employ a combination of two fundamental types of control activities:

- Preventative Controls:

- Purpose: These are proactive measures designed to stop errors, fraud, unauthorized activities, or other undesirable events from occurring in the first place. They are the first line of defense, preventing risks from materializing.

- Characteristics: They are implemented before a transaction or event takes place. They aim to reduce the likelihood of a risk event.

- Analogy: Imagine a robust firewall preventing malicious traffic from entering your network, or a requirement for dual authorization on large payments, preventing a single individual from making an unauthorized transfer. These controls are about putting barriers in place.

- Detective Controls:

- Purpose: These controls are designed to identify errors, fraud, or unauthorized activities after they have occurred. While they don't prevent the event, they are crucial for uncovering issues quickly so that corrective action can be taken and future occurrences can be mitigated.

- Characteristics: They are implemented after a transaction or event has taken place. They aim to reduce the impact of a risk event by ensuring its timely discovery.

- Analogy: Consider a regular bank reconciliation that uncovers an unrecorded transaction, or an intrusion detection system that alerts you to a breach attempt. These controls are about finding problems and triggering an immediate response.

Preventative controls are ideal for reducing exposure, but detective controls provide the critical safety net that ensures nothing slips through the cracks. A balanced approach leveraging both types creates a more robust and adaptive control framework.

Key Types of Effective Control Activities

Below are some of the most common, yet powerful, categories of control activities that form the backbone of sound internal control:

1. Authorization Controls

- Type: Primarily Preventative

- Description: Authorization controls ensure that only individuals who have been granted explicit authority can initiate, approve, or execute transactions, policies, or access resources. This critical control prevents unauthorized actions, misallocation of resources, and promotes accountability. It establishes clear lines of responsibility and prevents individuals from acting outside their designated authority.

- Examples:

- Approval Hierarchies: A system where purchases exceeding a certain monetary threshold require escalating levels of management approval (e.g., department manager for up to $1,000, VP for up to $10,000, CFO for over $10,000).

- Digital Signatures and Workflow Tools: Implementing electronic workflows that require specific digital approvals for contract finalization, vendor payments, or employee onboarding.

- Access Credentials: Using unique usernames, strong passwords, multi-factor authentication (MFA), access cards, or biometric scans to restrict physical or digital access to sensitive areas, systems, or data.

- Spending Limits: Imposing pre-set spending limits on corporate credit cards or expense accounts for individual employees.

2. Performance Reviews

- Type: Primarily Detective

- Description: Performance reviews involve systematic comparisons of actual results against predetermined benchmarks, budgets, forecasts, historical data, or industry standards. The objective is to identify significant variances, unexpected outcomes, or anomalies that may indicate errors, inefficiencies, or even fraudulent activity. Timely investigation of these discrepancies is key to corrective action.

- Examples:

- Budget vs. Actual Analysis: Regularly comparing departmental or organizational expenditures and revenues against approved budgets. Large variances trigger inquiries into the root causes.

- Key Performance Indicator (KPI) Monitoring: Tracking and analyzing critical operational metrics (e.g., production output, customer satisfaction rates, sales conversion ratios) and investigating significant deviations from targets.

- Trend Analysis: Reviewing historical financial data or operational metrics over time to identify unusual patterns or shifts that might indicate underlying problems.

- Bank Reconciliations: Periodically comparing the organization's cash balances per its accounting software to the bank statement balance, investigating any differences to ensure all transactions are accurately recorded.

- Inventory Shrinkage Analysis: Comparing physical inventory counts to perpetual inventory records to identify potential theft, damage, or recording errors.

- Variance Reporting: Generating detailed reports on variances between standard costs and actual production costs to identify inefficiencies.

3. Information Processing Controls

- Type: Both Preventative and Detective

- Description: These controls are fundamental in ensuring the accuracy, completeness, and validity of data as it is captured, processed, and reported within information systems. They are particularly critical in automated environments where manual intervention is limited. These controls aim to prevent erroneous or unauthorized data from entering or being processed by systems, and to detect it if it does.

- Examples:

- Input Controls (Preventative):

- Data Validation: Programmed checks to ensure data entered is in the correct format (e.g., numeric fields only accept numbers), falls within acceptable ranges (e.g., date of birth within a reasonable range), or conforms to predefined lists (e.g., valid product codes).

- Completeness Checks: Ensuring all required data fields are entered before a transaction can be saved.

- Pre-numbered Documents: Using sequentially numbered forms for invoices, purchase orders, or checks to ensure all transactions are accounted for and none are missing or duplicated.

- Input Controls (Preventative):

- Processing Controls (Preventative/Detective):

- Error Messages & Logging: Systems generating immediate error messages for invalid entries and logging all processing errors for review.

- Matching: Automated matching of documents (e.g., purchase order, goods receipt note, and vendor invoice) before payment is processed.

- Output Controls (Detective):

- Review of Error Reports: Regular review of system-generated error logs and exception reports.

- Reconciliations: Automated or manual reconciliations of data between different systems or reports (e.g., ledger balances to sub-ledger balances).

4. Physical Controls

- Type: Primarily Preventative

- Description: Physical controls involve tangible measures designed to safeguard assets, including cash, inventory, equipment, sensitive documents, and critical infrastructure, by restricting physical access to them. They aim to prevent theft, damage, unauthorized access, and environmental hazards.

- Examples:

- Access Restrictions: Locked doors, gates, security fences, key cards, biometric scanners (fingerprint, retinal scans) for entry to buildings, server rooms, data centers, and storage facilities.

- Asset Tagging & Tracking: Assigning unique tags to equipment and inventory and maintaining detailed records to track their location and movement.

- Surveillance: Security cameras (CCTV) monitoring key areas, entrances, and exits, with recordings reviewed periodically or when incidents occur.

- Security Guards: Manned security posts at entry points or patrolling facilities.

- Secure Storage: Using safes, vaults, and locked cabinets for valuable assets, cash, or highly confidential documents.

- Backup Power Supplies: Uninterruptible Power Supplies (UPS) and generators to ensure continuous operation of critical systems during power outages.

5. Segregation of Duties (SoD)

- Type: Primarily Preventative

- Description: Segregation of duties involves dividing responsibilities for a single transaction or process among different individuals. The core principle is that no single person should have complete control over all aspects of a transaction, from initiation to authorization, recording, and custody of related assets. This significantly reduces the opportunity for both errors and fraudulent activity, as collusion would be required to bypass the control.

- Examples:

- Cash Handling: The person who receives cash should not be the same person who records the cash in the accounting system or performs the bank reconciliation.

- Procurement Process: Different individuals should be responsible for:

- Authorizing a purchase (e.g., department manager).

- Placing the order with a vendor (e.g., purchasing agent).

- Receiving the goods (e.g., warehouse staff).

- Processing the invoice for payment (e.g., accounts payable clerk).

- Approving the payment (e.g., finance manager).

- Payroll: Separation between HR (employee setup, salary changes), timekeeping, payroll processing, and payment authorization.

- IT Operations: Segregating duties between system administrators, database administrators, application developers, and security personnel to prevent one person from having excessive control over critical systems and data.

- User Access Management: The person who grants user access to systems should not be the same person who performs regular access reviews or has unrestricted administrative privileges on those systems.

The Modern Battlefield: Cyber Attacks and Robust Mitigation Strategies

Cyberattacks pose an existential threat to organizations, risking data breaches, operational disruption, financial loss, and severe reputational damage. Effective control activities are the bedrock of any robust cybersecurity strategy. They are not merely IT functions but integrated components of organizational risk management.

How Control Activities Act as Pillars of Cyber Mitigation:

- Strong Preventative Controls:

- Multi-Factor Authentication (MFA): Elevating authorization controls beyond just passwords, making it harder for unauthorized users to gain access even if credentials are stolen.

- Network Segmentation & Firewalls: Physical and information processing controls that create isolated zones within a network, preventing attackers from moving freely if one segment is compromised.

- Endpoint Detection and Response (EDR) / Antivirus: Software that prevents and detects malware on individual devices, acting as a preventative information processing control.

- Regular Security Awareness Training: Educating employees to recognize phishing emails, suspicious links, and social engineering tactics – a critical human preventative control.

- Principle of Least Privilege: An authorization control ensuring users and systems are granted only the minimum access rights necessary to perform their legitimate functions, limiting potential damage from a compromise.

- Data Encryption: Encrypting sensitive data at rest and in transit (information processing control) to render it unreadable to unauthorized parties, even if breached.

- Vigilant Detective Controls:

- Security Information and Event Management (SIEM) Systems: These act as sophisticated performance reviews, collecting and analyzing security logs from across the IT infrastructure in real-time, identifying suspicious patterns or anomalies that indicate potential cyberattacks.

- Intrusion Detection/Prevention Systems (IDS/IPS): These continuously monitor network traffic for malicious activity or policy violations and can generate alerts or even block suspicious connections.

- Regular Security Audits & Penetration Testing: Independent third-party assessments that actively try to breach an organization's defenses to identify vulnerabilities before malicious actors do.

- Data Loss Prevention (DLP) Solutions: Tools that monitor, detect, and block the unauthorized transmission of sensitive information outside the organizational network (a detective information processing control).

Building a Resilient Control Environment

Effective control activities require continuous monitoring, evaluation, and adaptation to the evolving risk landscape.

By implementing a mix of preventative and detective controls, and actively leveraging them to counter sophisticated threats like cyberattacks, organizations can build a robust internal control system.

This not only safeguards assets and ensures compliance but also fosters operational efficiency, strengthens decision-making, and builds stakeholder trust.