The Finance Effectiveness Matrix: How Finance Teams Create Impact

Modern finance teams face a defining question:

- Are we recording value or creating it?

The traditional finance model was built for stability: periodic closes, annual budgets, compliance cycles, and post-mortem analysis. But today’s environment — defined by technological disruption, AI automation, capital volatility, and compressed decision cycles — demands something else.

It demands a shift from Reactive Information to Proactive Impact.

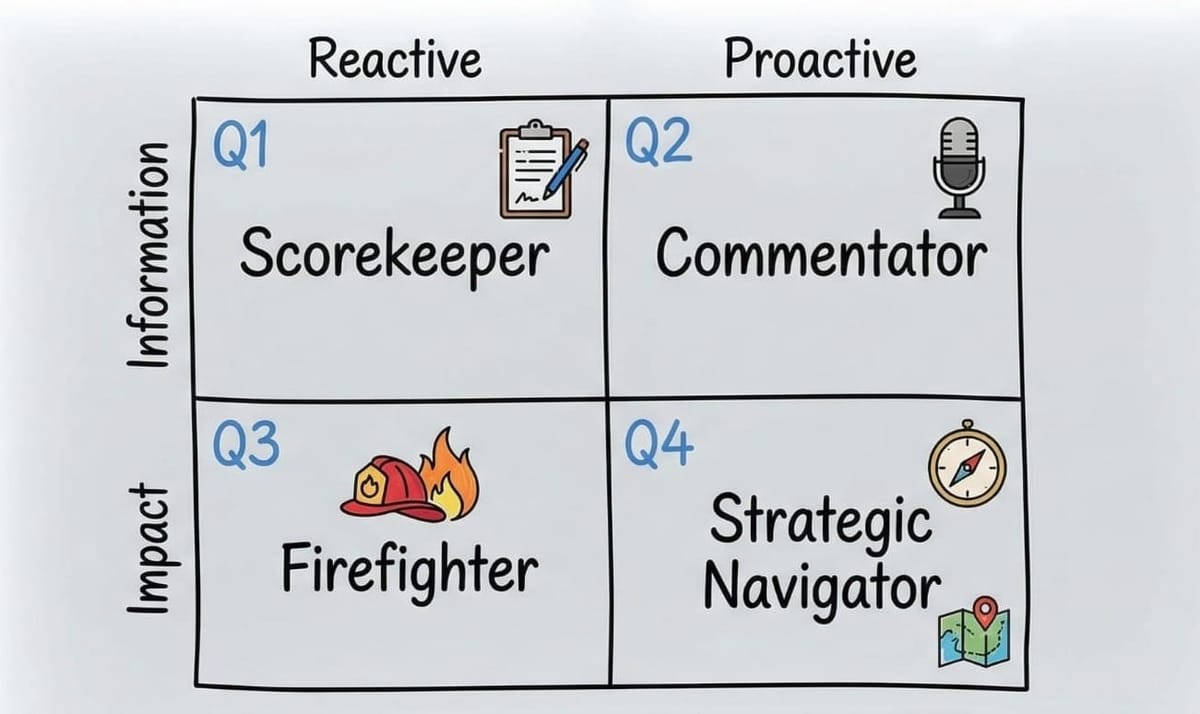

The Finance Effectiveness Matrix provides a practical framework for diagnosing where your finance function operates today — and how to systematically evolve it into a strategic force multiplier.

The Architecture of the Finance Effectiveness Matrix

The model is defined by two axes:

Axis 1: Time Orientation

Reactive (Past-Focused) ↔ Proactive (Future-Focused)

This axis measures latency between business events and finance engagement.

- Reactive finance measures what already happened.

- Proactive finance influences what will happen.

The shorter the latency — and the earlier finance intervenes — the greater the strategic leverage.

Axis 2: Value Delivery

Information (Outputs) ↔ Impact (Outcomes)

This axis measures whether finance delivers:

- Reports and data

or - Decisions, recommendations, and measurable business outcomes.

Information is necessary.

Impact is differentiating.

The Four Quadrants of Finance Maturity

Each quadrant represents a distinct operating model — not just in output, but in mindset, incentives, technology stack, and organizational psychology.

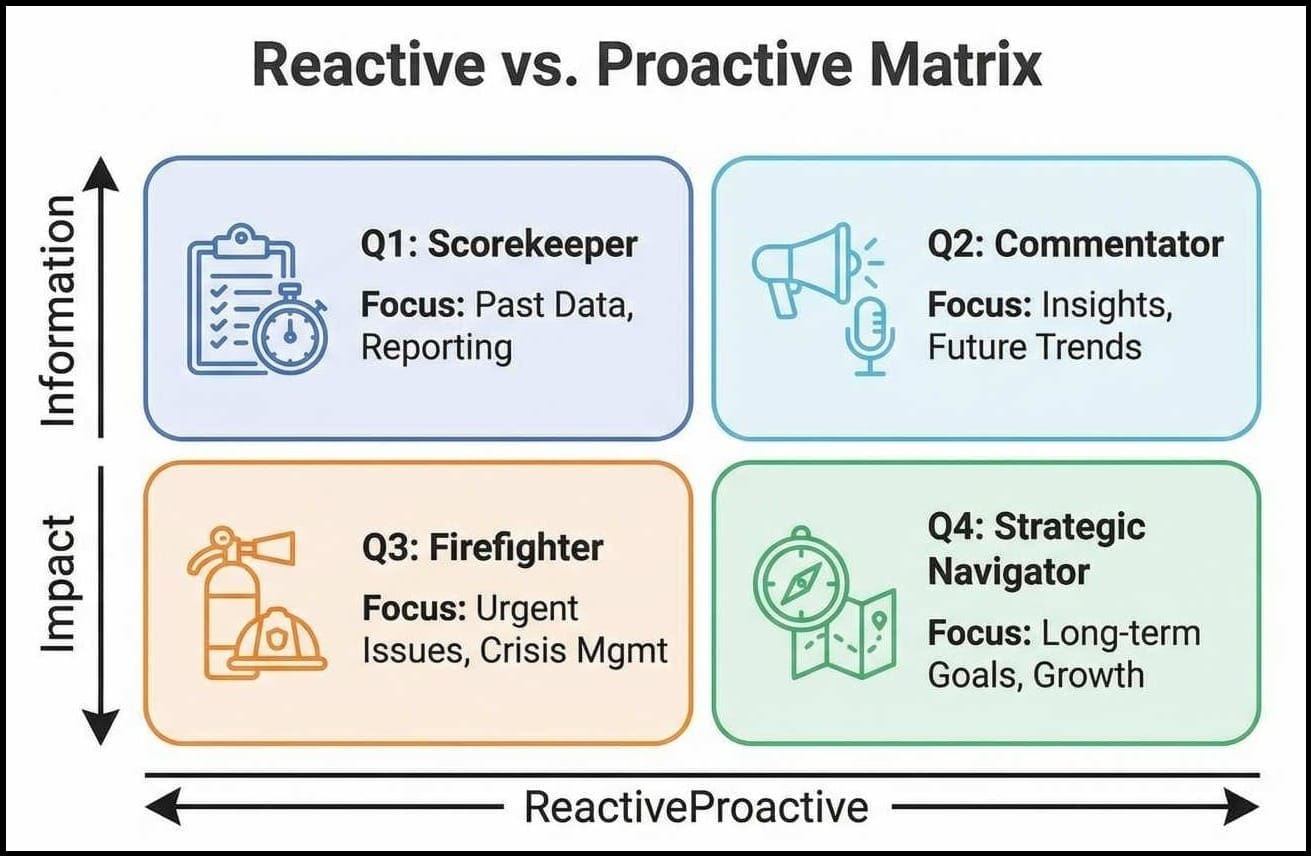

Quadrant 1: The Scorekeeper

Reactive + Information

This is the traditional finance archetype — historically respected, but strategically limited.

Core Identity

- Guardian of accuracy

- Owner of compliance

- Custodian of controls

Operating Model Characteristics

1. Transactional Dominance

- 60–80% of team time spent on:

- reconciliations

- manual journal entries

- data validation

- variance compilation

2. Calendar-Driven Workflow

The monthly close dictates life.

During close:

- finance disappears from strategic dialogue

- operational leaders wait for numbers

- decisions stall

3. Siloed Structure

- Finance interacts with business units mainly through cost policing.

- Relationship tone: enforcement, not partnership.

Strategic Risks of Staying Here

1. Commoditization

Transaction processing is the easiest function to automate or outsource.

If your value proposition is:

- We produce accurate reports.

Technology will eventually do it cheaper and faster.

2. Executive Marginalization

Scorekeepers rarely influence:

- capital allocation

- pricing strategy

- product investment

- growth decisions

They are invited to explain results — not shape them.

3. Strategic Blindness

When finance looks only at trailing indicators:

- leadership operates on stale assumptions

- performance surprises increase

- risk compounds silently

The organization drives while looking in the rearview mirror.

Typical KPIs in Q1

- Days to close

- Audit adjustments

- Transaction error rates

- Finance cost ratio

All efficiency metrics.

None strategic.

Quadrant 2: The Commentator

Proactive + Information

This is where many modern FP&A teams operate.

They forecast.

They model.

They analyze.

But they don’t always influence.

Core Identity

- Analysts

- Forecasters

- Insight producers

What Improves from Q1

- Rolling forecasts begin

- BI dashboards proliferate

- Scenario modeling increases

Finance becomes predictive — but not prescriptive.

The Insight Without Action Problem

1. Report Production ≠ Value Creation

The Commentator often confuses analytical sophistication with strategic influence.

50-slide decks.

Beautiful dashboards.

Granular forecasts.

But:

- Did behavior change?

- Did capital move?

- Did risk reduce?

If not, the value stops at information.

2. The News Anchor Effect

The Commentator says:

“Revenue will miss by 8%.”

The Navigator says:

“Shift $1.2M from Channel A to Channel B within 30 days to offset 6% of the shortfall.”

The difference is ownership.

3. Organizational Friction

Finance frustration often peaks here:

- “We warned them.”

- “They didn’t listen.”

- “We predicted this.”

Prediction without influence breeds cynicism.

Structural Gap

Most Q2 teams lack:

- embedded business partnering

- operational authority

- decision accountability

- executive sponsorship

The barrier isn’t data.

It’s proximity and trust.

Quadrant 3: The Firefighter

Reactive + Impact

This quadrant is high visibility — and high risk.

Finance becomes valuable during crisis.

Core Identity

- Crisis solver

- Cash protector

- Emergency negotiator

Typical Contexts

- High-growth startups

- Turnarounds

- Cash-constrained environments

- Post-acquisition chaos

The Hero Trap

Organizations often reward Firefighters because they:

- Save payroll at the last minute

- Restructure debt under pressure

- Slash costs quickly

But ask a deeper question:

Why was the crisis allowed to emerge?

Hidden Consequences

1. Burnout

Constant urgency leads to:

- high turnover

- emotional fatigue

- control breakdowns

2. Process Decay

When survival dominates:

- documentation slips

- preventative controls weaken

- strategy gets postponed

3. Short-Termism

Emergency cost cuts may:

- damage growth engine

- undermine morale

- sacrifice long-term value

Firefighting feels impactful — but often destroys strategic runway.

Quadrant 4: The Strategic Navigator

Proactive + Impact

This is the mature finance function.

Not reactive.

Not purely analytical.

Not heroic.

Strategic.

Core Identity

- Co-pilot to the CEO

- Capital allocator

- Value architect

Defining Capabilities

1. Driver-Based Management

Navigators model operational levers:

- pipeline coverage

- churn rate

- sales productivity

- hiring ramp

- customer acquisition cost

They understand that financial outcomes are downstream of operational inputs.

2. Scenario Governance

They manage through:

- Base case

- Upside case

- Downside case

- Strategic option cases

When triggers are hit, pre-agreed actions execute.

Uncertainty becomes manageable.

3. Embedded Partnership

Finance partners sit:

- in marketing planning sessions

- in product roadmap meetings

- in sales forecast reviews

They influence before commitments are locked.

4. Prescriptive Analytics

Navigator output looks like:

- “Delay hiring in Region B by 45 days.”

- “Increase enterprise pricing by 3% under elasticity assumption X.”

- “Accelerate product launch to capture window Y.”

Clear. Specific. Actionable.

Behavioral Shift Required

The jump to Q4 is not primarily technical.

It’s relational.

Finance must develop:

- storytelling capability

- conflict comfort

- intellectual courage

- cross-functional empathy

Influence requires trust.

The Role of Technology

Technology is not the strategy — but it enables the strategy.

To reach Quadrant 4, finance needs infrastructure that:

1. Automates Information

- real-time actuals ingestion

- close automation

- variance auto-commentary

Free time → higher cognition work.

2. Connects Drivers to Financial Outcomes

- CRM → revenue models

- HRIS → compensation modeling

- Operations → working capital impact

Without driver integration, finance remains descriptive.

3. Enables Real-Time Scenario Modeling

Strategic meetings require:

- instant modeling

- version control

- scenario comparisons

Spreadsheets break here. Platforms don’t.

4. Integrates AI for Insight Generation

AI can:

- auto-explain variances

- detect anomalies

- highlight risk clusters

Humans then focus on decisions.

A Practical Transformation Roadmap

Phase 1: Stabilize and Automate (Escape Q1)

- single source of truth

- close automation

- data governance

- KPI standardization

Outcome: time freed for analysis.

Phase 2: Predict (Build Q2)

- rolling forecasts

- leading indicator dashboards

- liquidity modeling

- risk pre-mortems

Outcome: earlier awareness.

Phase 3: Influence (Reach Q4)

- embed finance partners

- redefine meeting cadence

- deliver one-page action memos

- measure finance by decision impact

Outcome: strategic authority.

Measuring Finance Maturity

If you want to know whether you’ve truly evolved:

Q4 Indicators

- Forecast accuracy within ±5%

- Leading indicators embedded in >50% of reporting

- Finance involved in 100% of major initiatives

- Internal NPS >50 from business leaders

60% of finance time spent on analysis & strategy

If Finance cannot point to specific strategic decisions it shaped, you are not yet in Quadrant 4.

The Strategic Mandate

In hyper-competitive markets:

Reactive finance is a liability.

Predictive-only finance is insufficient.

Crisis finance is unstable.

Only proactive, impact-driven finance scales.

The future CFO is not the chief accounting officer.

They are the chief value architect.