FRC's Auditing Rules for Public Interest Entities

For auditors engaged with Public Interest Entities (PIEs) in the UK, understanding and rigorously applying the Financial Reporting Council's (FRC) rules and standards is not just a regulatory obligation – it's a profound responsibility to the capital markets and the wider public.

PIEs, by their very nature (e.g., listed companies, banks, insurers), impact a vast range of stakeholders, making the integrity and quality of their financial reporting, and the audit thereof, paramount.

The FRC, as the independent regulator of auditors in the UK, imposes its most stringent requirements on PIE audits. These rules are constantly refined, driven by a relentless commitment to enhance audit quality, safeguard public trust, and adapt to an ever-more complex corporate landscape.

The FRC's Mandate for PIEs: Why These Rules Matter Most

The FRC's core mission is to promote high standards of corporate governance and reporting to foster investment in the UK. For PIE auditors, this translates into an intensified framework designed to:

- Elevate Audit Quality: Ensure audits of PIEs are robust, reliable, and provide a true and fair view of financial statements, given their broad stakeholder impact.

- Guarantee Auditor Independence: Prevent any form of conflict of interest or familiarity that could compromise objectivity and impartiality, which is critical for maintaining investor confidence in PIEs.

- Demand Professional Scepticism: Foster an environment where auditors of PIEs are expected to exhibit a heightened degree of professional scepticism, rigorously questioning management's assertions and critically evaluating all audit evidence.

- Maintain Paramount Public Confidence: Reassure a vast array of stakeholders, including investors, creditors, employees, and the wider public, that audited financial information of PIEs is trustworthy and accurately reflects their financial position.

- Bolster Market Integrity: Directly contribute to a healthy, transparent, and trusted financial market in the UK by ensuring the highest standards of financial reporting and audit for its most significant entities.

Key Pillars of FRC Auditor Regulation for PIEs

The FRC's regulatory oversight for PIE auditors is comprehensive and demanding, encompassing several critical areas:

1. Auditing Standards: ISAs (UK)

The FRC develops and maintains UK Auditing Standards, which are largely based on the International Standards on Auditing (ISAs) but with specific UK enhancements. These enhancements often introduce greater rigour and specific requirements particularly relevant for PIEs, providing comprehensive guidance on:

- Auditor's Responsibilities: Clearly outlining the overarching objectives and responsibilities of the independent auditor, with an inherent understanding of the heightened public interest in PIE audits.

- Risk Assessment (ISA (UK) 315): Requiring auditors to gain a robust understanding of the PIE and its environment to identify and assess risks of material misstatement, whether due to fraud or error. This includes a strong focus on the PIE's complex IT systems and controls.

- Fraud in an Audit (ISA (UK) 240): For PIEs, there's a particularly intense focus on the auditor's responsibilities relating to fraud. The revised standard mandates a heightened level of professional scepticism, robust risk assessment procedures (especially regarding management override of controls), and a requirement to consider the need for specialist skills (e.g., forensic experts) when fraud or suspected fraud is identified.

- Auditing Accounting Estimates (ISA (UK) 540): For PIEs with complex financial instruments or significant judgments (e.g., fair value measurements, provisions), the FRC maintains a strong focus on how auditors challenge management's accounting estimates, the use of auditor's experts, and the sufficiency of audit evidence.

- Going Concern (ISA (UK) 570): For PIEs, auditors must robustly challenge management's going concern assessment, perform expanded audit procedures, apply a stand back requirement, and provide a positive conclusion in their audit report on the appropriateness of management's assessment and set out the work they have done in making their determination, including any key observations.

- Group Audits (ISA (UK) 600): Given the often complex structures of PIEs, the ISA (UK) 600 places significantly greater responsibility on the group engagement partner for the overall quality of the group audit. This includes proactive planning, supervision, and explicit responsibility for the competence, capabilities, and ethical compliance of all component auditors, regardless of their location.

2. Ethical Standard for Auditors

The FRC's Ethical Standard for Auditors is central to ensuring independence, integrity, and objectivity, and its most stringent provisions apply directly to PIE audits.

- Fundamental Principles: While applying to all audits, adherence to integrity, objectivity, professional competence and due care, confidentiality, and professional behaviour is under maximum scrutiny for PIEs.

- Threats to Independence: Auditors of PIEs face intense examination regarding all threats (self-interest, self-review, management, advocacy, familiarity, intimidation). The application of safeguards and the Objective, Reasonable, and Informed Third Party (ORITP) Test are paramount.

- Non-Audit Services (NAS) for PIEs: The rules are exceptionally strict for PIEs. There is a very short, narrowly defined list of permissible non-audit services that an auditor can provide to a PIE. Most other non-audit services are explicitly prohibited to prevent self-review or management threats.

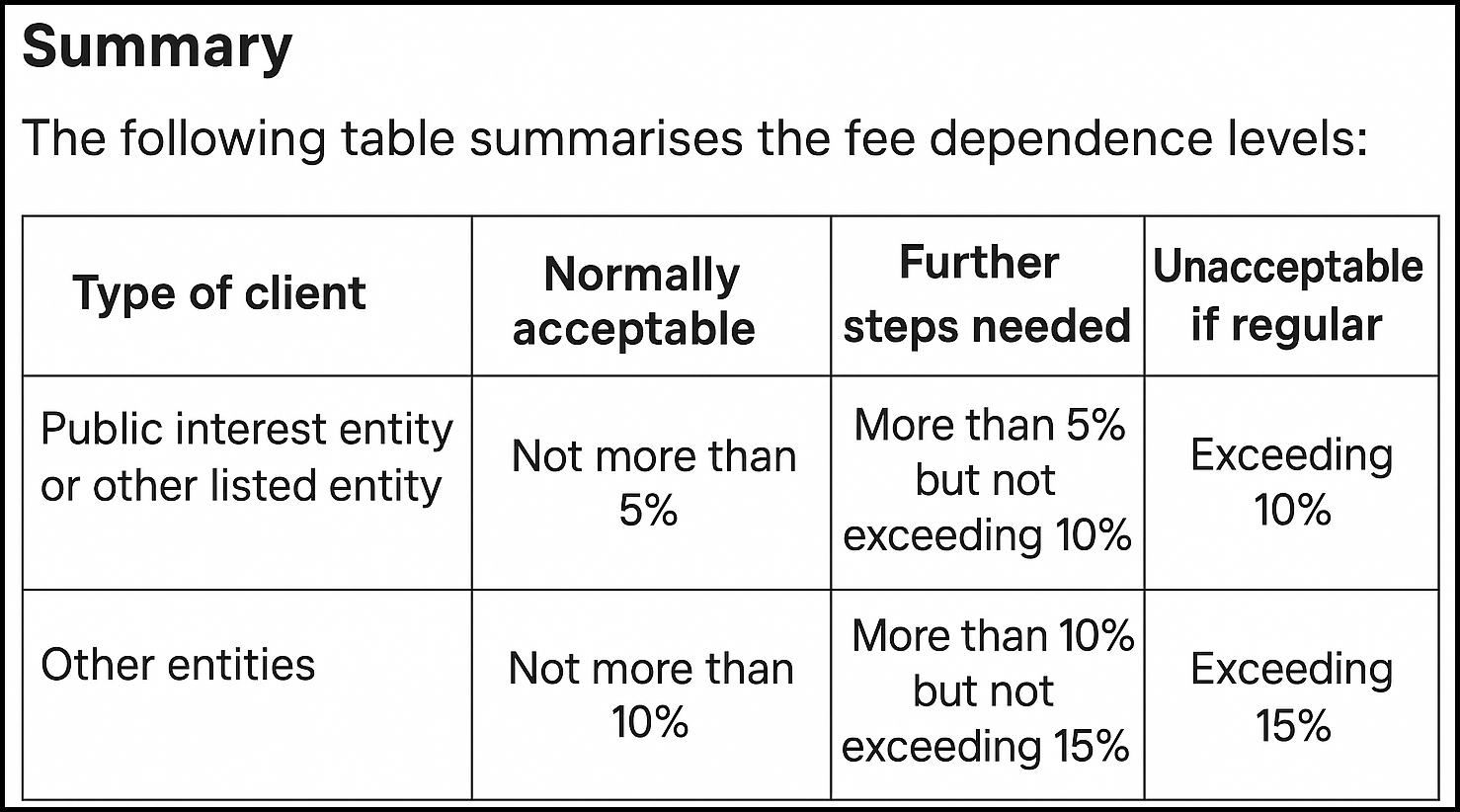

- Fee Restrictions for PIEs: For PIEs, rules around fee caps on non-audit services and targeted restrictions on fees from entities related by a single controlling party aim to prevent self-interest threats arising from excessive reliance on client fees.

- Breach Reporting: Enhanced requirements for audit firms to establish robust mechanisms to identify, evaluate, and report breaches promptly, with serious breaches in PIE engagements requiring immediate notification to the FRC.

3. Audit Quality Review (AQR) - Dedicated PIE Scrutiny

The FRC's Audit Quality Review (AQR) team's primary focus is on monitoring the quality of audit work undertaken by UK firms for PIEs and other significant entities. This involves:

- Targeted Inspections: Regular and often in-depth inspections of individual PIE audits, assessing the quality of work performed, the appropriateness of key audit judgments, and the sufficiency of audit evidence. These inspections critically examine adherence to all ISAs (UK) and the Ethical Standard.

- Firm-Wide Reviews: Comprehensive assessments of the effectiveness of firms' systems of quality management (SOQM), now governed by International Standard on Quality Management (UK). This includes reviewing areas like acceptance and continuation procedures, ethics and independence, and internal quality monitoring.

- Public Reporting: The FRC publishes detailed annual reports on its inspection findings, often providing specific insights into common areas of concern in PIE audits, driving improvements across the market.

4. Enforcement Actions

The FRC has robust enforcement powers to address misconduct or breaches of professional standards by auditors and audit firms, particularly when these relate to PIEs.

- Investigations: Conducting thorough investigations into suspected breaches under the Audit Enforcement Procedure. Cases involving PIEs often receive significant public attention.

- Sanctions: Imposing a range of severe sanctions, which can include substantial financial penalties, non-financial sanctions (e.g., mandatory training, prohibiting an engagement partner from signing audit reports for a period), and exclusions from professional bodies.

- Focus on Individual Accountability: Increasing emphasis on holding individual audit partners and engagement teams accountable for their actions and judgments on PIE audits.

5. Eligibility Criteria for Statutory Auditors

The FRC sets out stringent criteria for individuals and firms to be eligible for appointment as UK statutory auditors.

For firms auditing PIEs, there are additional registration and oversight requirements to ensure they possess the necessary scale, expertise, and quality control systems.

The Critical Role of the Audit Engagement Partner for PIEs

For PIEs, the audit engagement partner bears an even greater weight of responsibility and accountability. They are the ultimate custodian of audit quality for a PIE engagement, directly impacting public trust.

Key responsibilities of the audit engagement partner for PIEs include:

- Ultimate Responsibility for Audit Quality: The partner is fully accountable for the overall quality of the PIE audit, ensuring compliance with all enhanced ISAs (UK) and the stringent Ethical Standard.

- Heightened Professional Scepticism: Setting the tone and actively demonstrating a rigorous application of professional scepticism throughout the audit, especially in challenging management's complex judgments and estimates common in PIEs.

- Ensuring Independence: Taking paramount responsibility for ensuring the engagement team and the firm comply with all ethical requirements, particularly regarding independence, and that all threats are robustly identified, evaluated, and appropriately safeguarded or eliminated.

- Robust Direction, Supervision, and Review: Providing exemplary leadership, detailed supervision, and thorough review of all aspects of the PIE audit, ensuring the work performed is sufficient, appropriate, and supports the audit opinion.

- Complex Consultations: Facilitating and documenting appropriate consultation on highly complex or contentious matters often encountered in PIE audits (e.g., derivative valuations, complex revenue recognition, or litigation provisions).

- Engagement Quality Control Review (EQCR): For PIE audits, an EQCR is mandatory. The engagement partner must ensure this review is performed effectively and that all findings raised by the independent reviewer are addressed before the audit report is signed.

- Communication with Those Charged with Governance: Maintaining exceptionally clear and effective communication with the PIE's Audit Committee, including sensitive topics like identified fraud risks, significant internal control deficiencies, and the robustness of the going concern assessment.

Implication for PIE Audit Partners: The FRC's increasing focus on individual accountability means that PIE audit partners are under intense scrutiny. Any failure in audit quality or breach of independence rules can lead to severe sanctions for the individual.

Upholding Independence and Navigating Partner and Firm Rotation for PIEs

Independence is the absolute bedrock of auditing, and for PIEs, the FRC's Ethical Standard and related regulations impose the most stringent requirements to safeguard it. This includes specific rules around the long association of audit personnel and the audit firm itself.

Auditor Independence for PIEs: The Core Principle

For PIEs, auditor independence must be beyond reproach, both in fact and in appearance. The identification, evaluation, and safeguarding against all threats to independence (Self-Interest, Self-Review, Management, Advocacy, Familiarity, Intimidation) are subject to intense scrutiny by the FRC.

Audit Partner and Firm Rotation Rules for PIEs

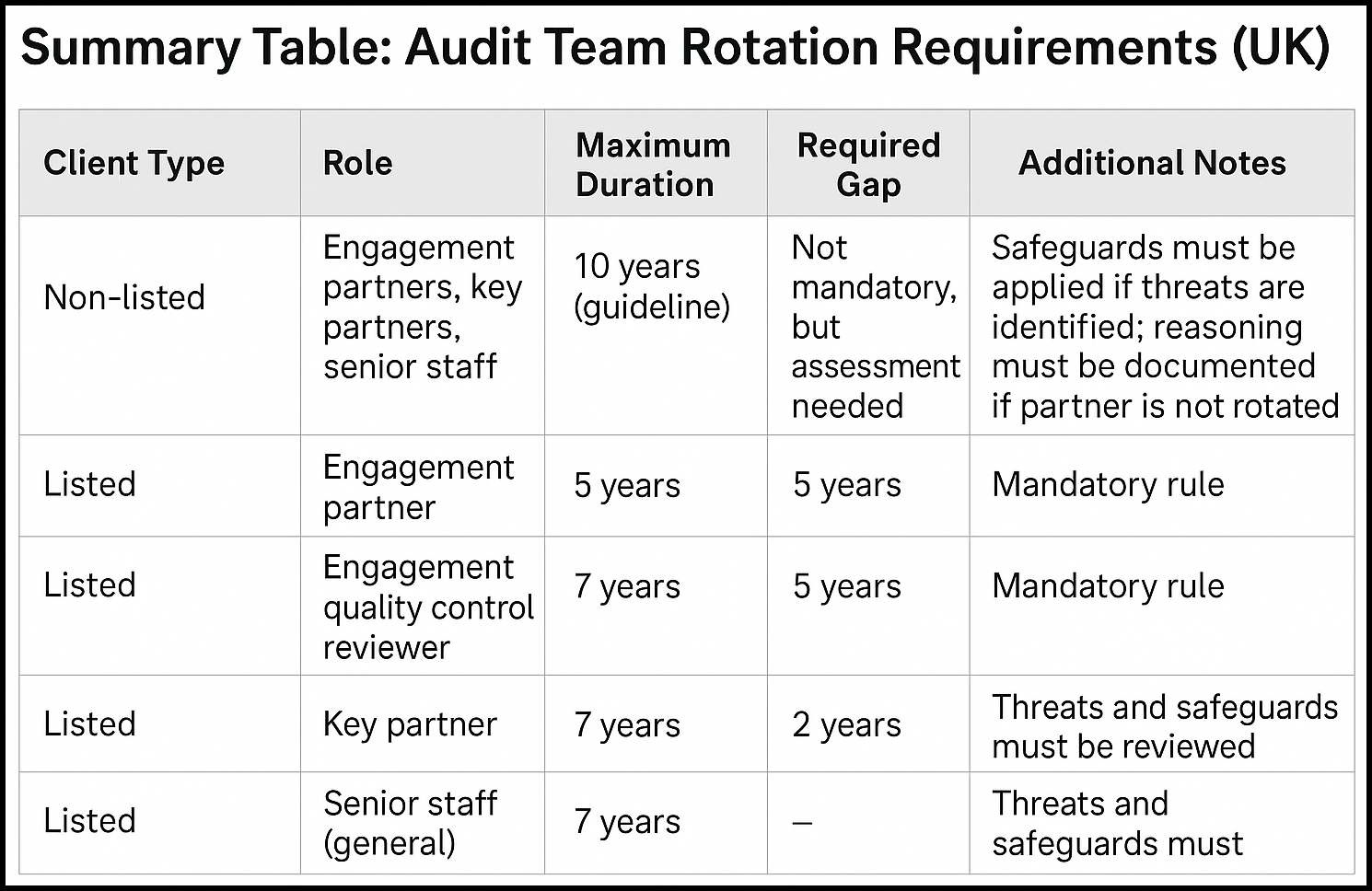

Long association with a PIE is identified as a significant threat to independence due to the potential for familiarity. The FRC mandates strict rotation rules to mitigate this threat:

- Key Audit Partner Rotation for PIEs: For audits of PIEs, the FRC Ethical Standard mandates the rotation of the engagement partner and other key audit partners (such as the Engagement Quality Reviewer and partners responsible for significant components of a group audit).

- The maximum tenure for these individuals on a PIE audit engagement is five years.

- Following this five-year period, there is a mandatory cooling-off period of five years before that individual can return to the audit of that specific PIE. This ensures a fresh perspective and breaks any long-standing relationships that could impair independence.

- Mandatory Audit Firm Rotation for PIEs: In addition to partner rotation, there are stringent rules for the rotation of the audit firm itself for PIEs, a direct consequence of the retained EU Audit Regulation.

- A PIE is generally required to put its audit out to tender at least every 10 years.

- The maximum continuous engagement period for an audit firm is generally 20 years. This 20-year period is achieved by requiring a mandatory tender after 10 years, which, if the incumbent firm is re-appointed, can be extended for a further 10 years, before a full rotation of the audit firm is required.

- These rules are designed to prevent excessive familiarity between the audit firm and the PIE, fostering greater challenge and scepticism over the long term.

Implication for PIE Auditors and Firms: Compliance with these rotation rules is a non-negotiable legal and ethical requirement for PIEs. Audit firms must have sophisticated systems in place to track partner and firm tenure and manage rotations well in advance. Failure to adhere to these rules can lead to severe FRC sanctions, including significant financial penalties for both the firm and individual partners, as well as public reprimands.

Conclusion

The FRC's enhanced auditor rules for Public Interest Entities are a cornerstone of financial integrity and public trust in the UK's capital markets. For audit professionals engaged with PIEs, a deep understanding and unwavering commitment to these rigorous regulations are a fundamental prerequisite.