Identifying and Mitigating Key Business Risks

Success is rarely a smooth, predictable journey.

Companies constantly face a myriad of potential challenges that can impact their operations, profitability, and even survival.

Identifying these business risks and implementing effective mitigation strategies is not just good practice – it's essential for long-term resilience and growth.

This post explores a range of common business risks, drawing on examples, and outlines practical approaches to mitigate them.

Understanding Business Risk

Business risk refers to the exposure a company has to factors that can negatively affect its financial performance or ability to achieve its objectives.

These risks can stem from internal weaknesses or external market forces.

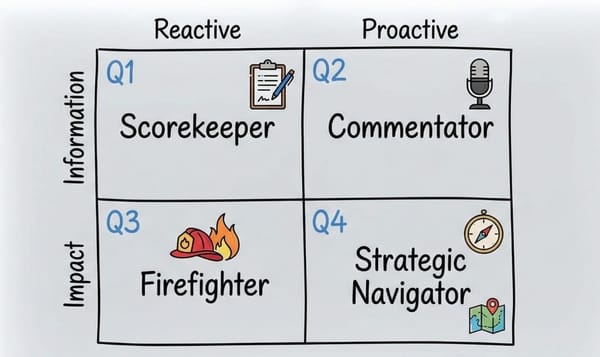

Proactive risk management involves identifying potential risks, assessing their likelihood and potential impact, and developing strategies to reduce or control them.

Here are some potential business risks and how to mitigate them:

1. Change in Technology

- Risk: Rapid technological advancements can lead to declining demand for existing products and services, resulting in reduced sales and profitability if the business fails to adapt.

- Mitigation:

- Continuously review the product and service mix to ensure offerings remain relevant in a changing market.

- Invest in market research to understand emerging trends and identify areas where the business can innovate or adapt.

- Formulate a long-term strategy that incorporates technological changes and outlines how the business will maintain its relevance.

- Analyze the profitability of existing products and be prepared to shift focus to more viable areas, even if margins on newer products need careful assessment.

2. Going Concern Threats

- Risk: Difficulties in meeting financial obligations, such as bank overdraft limits being reached or increasing trade payable days, can threaten the company's ability to continue trading (going concern). A key supplier could potentially initiate liquidation proceedings if debts are unpaid.

- Mitigation:

- Develop robust cash flow projections and regularly analyze profitability, particularly for key products and services.

- Implement and monitor Key Performance Indicators (KPIs) for cash management and working capital management (e.g., inventory levels, debtor days, creditor days).

- Maintain open communication with lenders and suppliers.

- Seek to renegotiate terms with banks or explore external financing options if necessary.

3. Not Fully Utilizing Existing Assets

- Risk: Holding onto underutilized or obsolete assets ties up capital and incurs ongoing costs without generating revenue, impacting overall profitability.

- Mitigation:

- Regularly review all company assets to identify those that are not being fully utilized.

- Develop plans to either bring underutilized assets into productive use, sell them off, or repurpose them to maximize their contribution to the business.

4. Poor Diversification Strategy

- Risk: Investing in unsuitable or unprofitable new products or ventures can lead to financial losses, especially if these require significant write-offs and the company has limited cash reserves.

- Mitigation:

- Conduct thorough analysis and due diligence before investing in new products or diversifying the business.

- Ensure all directors are involved in and sign off on strategic decisions regarding diversification to ensure collective agreement and direction.

5. Over-Reliance on Key Individuals

- Risk: When strategic decision-making is concentrated in the hands of one individual, the company lacks independent oversight and the benefit of diverse perspectives, potentially leading to poor decisions.

- Mitigation:

- Consider appointing a non-executive or additional executive director to the board to provide a balanced perspectives and challenge key decisions.

6. Lack of Focus

- Risk: Directors or key personnel being distracted by outside interests can dilute focus on the core business, hindering its success.

- Mitigation:

- Regularly review the effectiveness of directors and the leadership team.

- Strengthen corporate governance to ensure clear objectives and accountability.

7. Customers in Financial Difficulty

- Risk: Customers experiencing financial problems can lead to delayed payments, bad debts, and significant cash flow issues for the business extending them credit.

- Mitigation:

- Strictly enforce credit control policies and terms.

- For customers in difficulty, explore arranging payment plans for existing debts but consider requiring payment in advance or ceasing to provide further credit until the situation improves.

- Regularly review the aged debtors ledger to identify and chase long outstanding payments proactively.

8. Lack of Financing

- Risk: Insufficient access to finance can hinder the company's ability to pursue growth strategies, such as investing in new product ranges or expanding operations.

- Mitigation:

- Proactively engage with banks and lenders to renegotiate terms or seek to extend funding lines.

- Explore alternative external finance options.

- Improve working capital management, including optimizing stock levels and tightening credit control.

9. Circumvented Controls / Potential Fraud

- Risk: Weak internal controls can lead to errors in accounting, unauthorized payments, misappropriation of funds, and even fraud.

- Mitigation:

- Implement and regularly review internal controls to ensure they are effective and being followed.

- Establish clear authorization procedures for payments and transactions.

- Consider independent reviews of accounting processes.

10. Poor Inventory Controls and Systems

- Risk: Inadequate stock control and security measures increase the risk of theft or loss of inventory, particularly for high-value or easily tradable items.

- Mitigation:

- Improve inventory management systems and procedures.

- Ensure high-risk and high-value stock is stored securely with restricted access.

- Implement regular stock takes and reconciliation.

11. Insufficient Security and Back-up of Accounting Software

- Risk: Lack of proper back-up procedures for accounting software can lead to data loss, disrupting operations, impacting customer service, and potentially causing non-compliance with legal record-keeping requirements.

- Mitigation:

- Conduct a risk assessment of existing systems to determine the required level of security and back-up.

- Implement a robust back-up plan with regular, automated backups stored securely off-site.

- Regularly test the restoration process to ensure data can be recovered effectively.

12. Poor Hardware Security

- Risk: Physical damage to or loss of critical hardware, such as servers, can cripple the business's ability to trade and serve customers.

- Mitigation:

- Introduce physical security measures for critical hardware (e.g., secure server room access).

- Ensure appropriate environmental controls (heating, cooling, fire suppression).

- Have a disaster recovery plan that includes provisions for back-up servers and equipment to enable continued operation in the event of hardware failure. Consider the lead time for replacement hardware when developing this plan.

13. Unrelated or Unmonitored Investments

- Risk: Investing in ventures outside the core business without proper due diligence or ongoing monitoring can lead to significant financial losses.

- Mitigation:

- All investment decisions should be supported by thorough due diligence and a comprehensive risk assessment.

- Ensure investments align with the long-term strategic goals of the business.

- Properly document all investment transactions and establish a system for monitoring the performance of investments.

14. High Staff Turnover / Poor Staff Morale

- Risk: High staff turnover and low morale can lead to decreased productivity, increased recruitment and training costs, loss of valuable knowledge, and potential impact on the quality of products or services. Severe understaffing can strain existing employees and further damage morale.

- Mitigation:

- Regularly review staffing requirements and develop a proactive recruitment and retention strategy.

- Investigate the root causes of low morale and high turnover through surveys or exit interviews.

- Implement measures to improve the workplace culture and address employee concerns.

- In the short term, consider temporary staffing solutions to alleviate pressure on existing employees and maintain service quality. Monitor staff turnover as a key indicator of the effectiveness of these measures.

15. Supply Chain Disruptions

- Risk: Reliance on a limited number of suppliers or those in unstable regions can lead to significant disruptions in the supply of goods or services due to unforeseen events like natural disasters, political instability, or supplier failure.

- Mitigation:

- Diversify the supplier base to reduce reliance on a single source.

- Develop strong relationships with key suppliers and encourage transparency regarding their own supply chain risks.

- Consider holding buffer stock of critical components.

- Develop contingency plans for alternative sourcing or production methods in case of disruption.

- Explore near-shoring or re-shoring options for critical parts of the supply chain.

16. Cyber Security Threats

- Risk: Increasingly sophisticated cyber-attacks (e.g., malware, ransomware, data breaches) can lead to significant financial losses, reputational damage, legal liabilities, and operational standstill.

- Mitigation:

- Implement robust cyber security measures, including firewalls, antivirus software, and intrusion detection systems.

- Provide regular cyber security training for all employees to raise awareness of threats like phishing.

- Enforce strong password policies and multi-factor authentication.

- Regularly back up critical data and test the restoration process.

- Consider cyber insurance to mitigate financial losses in the event of an attack.

- Limit access to sensitive data based on employee roles.

17. Economic Downturns

- Risk: Recessions or significant economic slowdowns can lead to decreased customer spending, reduced demand for products and services, and increased pressure on profitability.

- Mitigation:

- Maintain a strong balance sheet with sufficient cash reserves.

- Diversify the customer base and explore new markets.

- Develop flexible cost structures that can be adjusted during downturns.

- Offer value-for-money products or services that remain attractive during economic hardship.

- Strengthen customer relationships to encourage loyalty.

18. Changes in Regulations and Compliance

- Risk: New laws, regulations, or changes to existing ones can increase compliance costs, restrict business activities, or create legal liabilities if not adhered to.

- Mitigation:

- Stay informed about relevant legislative and regulatory changes.

- Establish robust internal compliance procedures and training programs for employees.

- Seek legal advice when necessary to ensure full compliance.

- Appoint a compliance officer or team depending on the size and complexity of the business.

- Regularly review and update policies and procedures to reflect regulatory changes.

19. Reputational Damage

- Risk: Negative publicity, customer complaints, ethical lapses, or product failures can severely damage the company's reputation, leading to loss of customer trust, decreased sales, and difficulty attracting talent.

- Mitigation:

- Maintain high standards of product or service quality and customer service.

- Develop a strong ethical code of conduct and ensure it is embedded in the company culture.

- Have a crisis communication plan in place to manage negative publicity effectively and transparently.

- Monitor social media and online reviews to identify and address potential issues promptly.

- Be proactive in communicating positive company news and values.

Conclusion

Managing business risks is an ongoing process.

By proactively identifying potential threats across various aspects of the business – from internal operations and financial health to external market forces and regulatory changes – and implementing appropriate mitigation strategies, organization's can enhance their resilience, protect their assets, and increase their chances of achieving sustainable long-term success.