Market Sizing Explained: TAM, SAM, SOM & Earlyvangelists (EVG)

Why Market Sizing Matters

Whether you’re an investor evaluating a pitch deck, a founder mapping growth, or an executive planning expansion, understanding a market’s true potential is crucial.

Market sizing provides the framework to estimate opportunities, set realistic goals, and secure investor confidence.

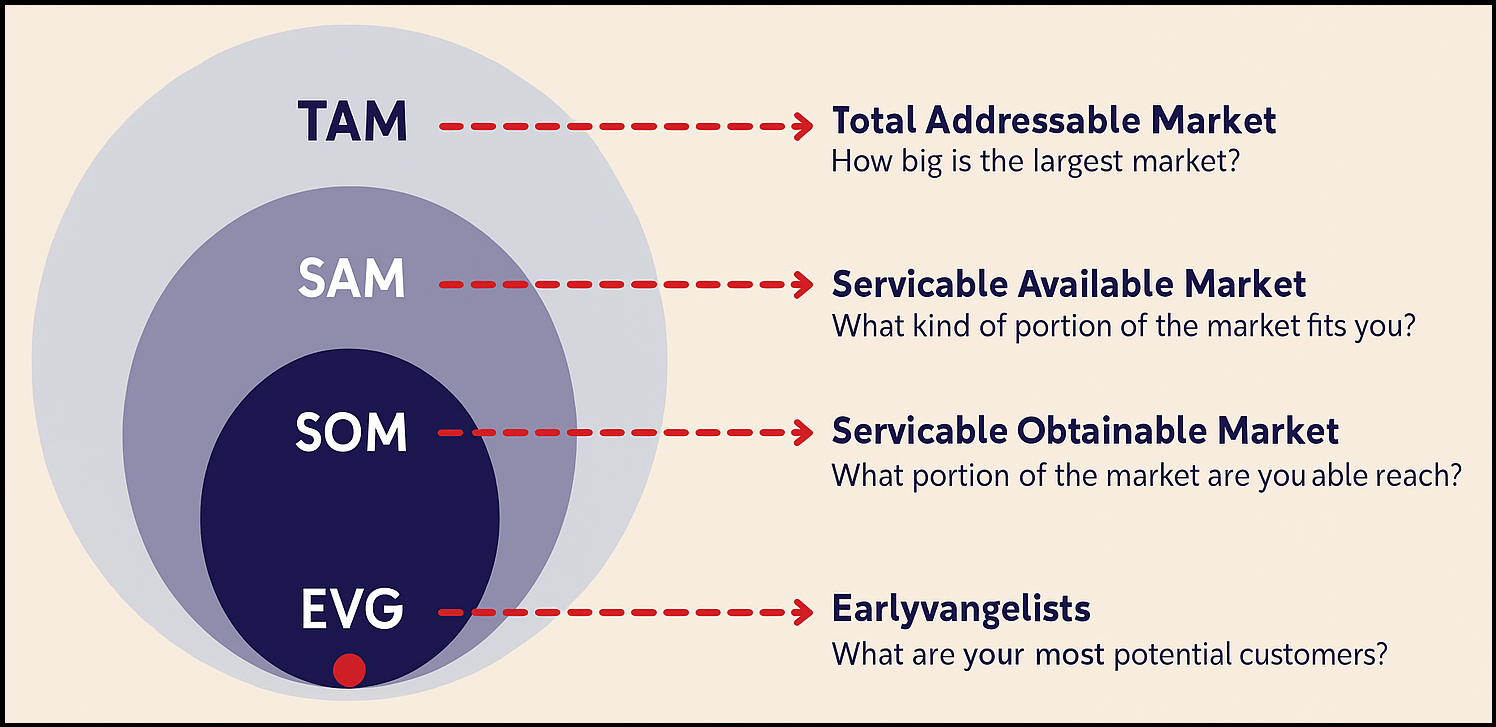

Market sizing involves three key metrics—TAM, SAM, and SOM—plus a fourth, often overlooked concept: Earlyvangelists (EVG).

What is TAM in Market Sizing?

TAM (Total Addressable Market) represents the maximum revenue opportunity if your company captured 100% of the market. It’s the broadest estimate of potential demand.

Example: For an AI-powered personal assistant, TAM could include global spending on human assistants, productivity software, and existing digital assistants.

Why it matters: TAM shows long-term growth potential and signals whether an industry is big enough to attract investors and support multiple players.

What is SAM in Market Sizing?

SAM (Serviceable Available Market) is the portion of the TAM that your business can realistically target based on geography, product features, and business model.

Example: For the AI assistant, the SAM could be digital assistants used by small business owners in the US and UK.

Why it matters: SAM refines the opportunity into a realistic target, forming the basis for short-term projections and strategic planning.

What is SOM in Market Sizing?

SOM (Serviceable Obtainable Market) is the slice of SAM your business can realistically capture within 1–3 years, factoring in competition, sales capacity, and marketing resources.

Example: If the AI assistant company expects to capture 2% of the US/UK small business digital assistant market in two years, that 2% is its SOM.

Why it matters: SOM informs tactical planning, investor confidence, and achievable sales targets.

Beyond the Trio: Earlyvangelists (EVG)

Earlyvangelists are more than early adopters. They are your first customers with urgent, unsolved problems, budget authority, and a willingness to test new solutions.

Key Traits of Earlyvangelists:

- Deep awareness of the problem

- Actively seeking solutions

- Budget and authority to buy

- Willingness to tolerate imperfections

- Evangelistic promotion if satisfied

Why they matter: EVGs validate product-market fit, provide early revenue, offer valuable feedback, and help generate organic growth.

How to Calculate Market Size: Top-Down vs Bottom-Up

Top-Down Approach

- Method: Start with broad industry data, then narrow by filters (e.g., geography, product type).

- Example: Start with global auto market → EV share → sedan/SUV share → target region.

- Pros: Fast, useful for TAM.

- Cons: Risk of overestimation.

Bottom-Up Approach

- Method: Build from customer-level data: number of potential buyers × average revenue per user.

- Example: For SaaS, estimate companies × users per company × subscription fee.

- Pros: More accurate for SAM/SOM, customer-driven.

- Cons: Requires detailed research.

Best practice: Combine both methods. Use top-down for TAM estimates and bottom-up for SAM/SOM validation.

Why These Metrics Are Important

For Investors:

- TAM: Long-term growth potential

- SAM: Near-term opportunity validation

- SOM: Execution feasibility

- EVG: Proof of demand and traction

For Founders & Startups:

- Idea validation & strategic focus

- Resource allocation and fundraising

- Early customer feedback loops

For Established Companies:

- New product launch feasibility

- Market expansion opportunities

- Competitive benchmarking

- Long-term strategy and M&A planning

Common Market Sizing Pitfalls

- Markets shift: Technology, regulation, and consumer behavior change rapidly.

- Assumptions drive results: Always state assumptions clearly.

- Data quality varies: Use reputable sources and primary research.

- Size ≠ Profitability: A large TAM doesn’t guarantee profit; consider competition and costs.

FAQs on Market Sizing

Q: What is the difference between TAM, SAM, and SOM?

A: TAM is total market demand, SAM is the portion you can serve, and SOM is the realistic share you can capture.

Q: How do you calculate market sizing?

A: Use a top-down approach (start broad, narrow down) or a bottom-up approach (customer-level estimates). Combining both works best.

Q: Who are Earlyvangelists (EVG)?

A: They are early customers with urgent problems, budget, and willingness to adopt and promote your product.

Q: Why do investors care about TAM, SAM, and SOM?

A: These metrics show market potential, realistic revenue opportunities, and execution strategy.

Bringing It All Together

- Start Broad (TAM): Validate big-picture potential.

- Get Realistic (SAM): Define the segment you can serve now.

- Be Tactical (SOM): Set achievable near-term goals.

- Fuel Growth (EVG): Engage your first passionate customers.

Market sizing isn’t just about numbers - it’s about strategy, validation, and execution.