Medline Industries IPO: Inside the Biggest Healthcare Listing of 2025

Why the Medline IPO Matters

When Medline Industries finally rang the Nasdaq bell in December 2025, it wasn’t just another IPO — it was the end of a 44-year private run by one of the most influential companies in U.S. healthcare logistics.

At $6.26 billion raised and a valuation north of $46 billion, Medline became the largest private-equity-backed IPO on record and the most closely watched public listing of the year.

For investors, the deal offered something rare in modern markets: a scaled, profitable, defensive growth company tied directly to non-discretionary healthcare spending.

This article breaks down Medline’s IPO, its century-long evolution, financial structure, AI-driven supply chain strategy, and what investors should realistically expect going forward.

A Century in the Making: Medline’s Unusual Origin Story

Medline’s roots stretch back to 1910 Chicago, when founder A.L. Mills ran a small garment factory producing aprons for stockyards. Just two years later, Mills identified a higher-value opportunity: healthcare textiles.

By 1912, the business had pivoted into hospital supplies, laying the groundwork for a strategy that would define Medline for the next century — manufacturing proprietary products while distributing third-party medical supplies.

Key milestones include:

- 1920s: Expansion from textiles into general medical distribution

- 1966: Re-founding of Medline Industries by Jim and Jon Mills

- 1977: Taken private again after a brief public listing

- 1985–1996: Expansion into surgical trays and prime vendor contracts

- 2021: $34B leveraged buyout led by Blackstone, Carlyle, and Hellman & Friedman

For more than four decades, Medline quietly became the largest privately held medical supplier in the U.S., compounding revenue through recessions, healthcare reform, and a global pandemic.

The 2025 Medline IPO: Deal Structure and Market Reception

After delaying an initial filing in 2024 due to market volatility, Medline relaunched its IPO effort in fall 2025 under far more favorable conditions.

IPO Snapshot

| Metric | Detail |

|---|---|

| Ticker | MDLN |

| Exchange | Nasdaq Global Select |

| Shares Offered | 216 million |

| IPO Price | $29.00 |

| Capital Raised | $6.26 billion |

| Initial Valuation | ~$46 billion |

The deal was led by Goldman Sachs, Morgan Stanley, BofA Securities, and J.P. Morgan, supported by a syndicate of over 40 banks.

Demand proved overwhelming. The offering was reportedly 10x oversubscribed, pricing at the top of the expected range.

First-Day Performance

Medline shares opened at $35, surged intraday, and closed at $41, delivering a 41% first-day gain (IPO Price: $29) and pushing valuation closer to $55 billion.

For institutional investors, the appeal was simple: Medline represented predictable cash flows, real assets, and healthcare exposure in a market dominated by speculative growth stories.

Medline’s Business Model: Why Investors Pay a Premium

Medline is not a traditional medical distributor — and that distinction explains much of its IPO valuation.

1. Vertically Integrated Manufacturing

Medline manufactures roughly one-third of its branded products across 33 global facilities, including:

- Surgical kits and trays

- Wound care and infection prevention

- Mobility and home-care products

While branded products account for less than half of total revenue, they generate over 80% of adjusted EBITDA, thanks to higher margins and pricing control.

2. Prime Vendor Distribution Network

The second half of Medline’s model is distribution:

- 335,000+ SKUs

- 69 global distribution centers

- 95% next-day delivery coverage in the U.S.

Its prime vendor contracts lock hospitals into multi-year, sole-source relationships, producing a 98% retention rate — one of the highest in healthcare logistics.

Financial Performance: Stability at Scale

Medline entered public markets already profitable and cash-generative — a rarity among mega IPOs.

Key Financials

- Net Sales 2024: $25.5B | 2025: ~$27.5B

- Net Income 2024: $1.2B | 2025: ~$1.3B

- Adjusted EBITDA 2024: $3.4B | 2025: ~$3.8B

- Gross Margin 2024: 25–28% | 2025: 25–28%

The company’s ability to combine manufacturing margins with distribution scale allows it to outperform peers like McKesson and Cardinal Health on profitability.

AI, Automation, and the Supply Chain Control Tower

One of the most underestimated aspects of Medline’s story is its transformation into a technology-first logistics company.

SAP on Microsoft Azure

Medline migrated core SAP systems to Microsoft Azure, enabling:

- 80% faster transaction processing

- 60% lower response times

- Near real-time inventory visibility

This infrastructure is foundational for the company’s next phase.

Mpower: AI-Driven Supply Chain Intelligence

Launching fully in 2026, Mpower is Medline’s AI control tower:

- Predictive analytics to flag supply disruptions

- AI chat tools for clinicians and procurement teams

- Automated approvals for substitutions during shortages

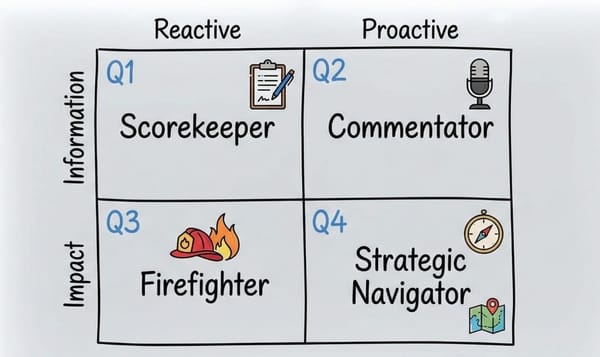

The platform aims to shift healthcare logistics from reactive problem-solving to proactive risk management.

Robotics and Warehouse Automation

Medline has also invested heavily in physical automation:

- AutoStore robotic picking systems

- Automated guided vehicles (AGVs)

- Robotic sorting and packaging

- Custom box dimensioning to reduce waste

These investments help offset chronic labor shortages while improving accuracy and throughput.

Growth Drivers Through 2026 and Beyond

Several secular trends support Medline’s long-term outlook:

Aging Population & Home-Based Care

As U.S. demographics skew older, demand for home-care supplies, mobility aids, and OTC products continues to rise — a trend reinforced by Medline’s acquisition of United MedCo.

Shift to Lower-Cost Care Settings

Healthcare is migrating from hospitals to ambulatory surgery centers and physician offices, where Medline’s value-priced branded products are especially competitive.

International Expansion

With operations in 125 countries, Medline plans targeted acquisitions in Europe and Latin America to deepen its manufacturing and distribution footprint.

Key Risks Investors Should Watch

No IPO is risk-free, even one as well-positioned as Medline.

Tariffs and Trade Policy

Medline estimates tariffs could reduce pre-tax income by $325–$375 million in 2025, with further pressure in 2026.

Leverage from the 2021 LBO

Despite IPO debt repayment, leverage remains elevated. Future capital allocation decisions by private-equity sponsors will matter.

Competitive Pricing Pressure

Large rivals like McKesson and Cardinal Health retain the ability to compress margins if pricing wars emerge.

Base, Bull, and Bear Scenarios

- Bull case: AI platform creates a defensible moat; margins approach 30%

- Base case: ~10% annual revenue growth; steady deleveraging

- Bear case: Tariffs + debt + pricing pressure compress valuation multiples

Most institutional investors appear to be pricing in the base case, with upside optionality tied to technology execution.

A New Kind of Healthcare Infrastructure Stock

Medline’s 2025 IPO represents the emergence of a new public healthcare infrastructure platform.

By combining:

- High-margin manufacturing

- Locked-in distribution relationships

- AI-driven supply chain intelligence

Medline offers investors exposure to non-cyclical healthcare demand with operational upside. While risks around trade policy and leverage remain, the market’s response suggests confidence in Medline’s role as a backbone of modern healthcare delivery.

FAQs

Is Medline Industries profitable after its IPO?

Yes. Medline was profitable prior to going public, with over $1.2 billion in net income in 2024.

What makes Medline different from other medical distributors?

Its vertically integrated model combines manufacturing and distribution, resulting in higher margins and stronger customer retention.

Is Medline a defensive stock?

Yes. Demand for medical supplies is non-discretionary, making Medline relatively resilient during economic downturns.