The Leveraged Buyout (LBO) Model

In the world of private equity and mergers & acquisitions, Leveraged Buyout (LBO) Models are vital decision-making tools.

These financial models enable investors to assess the viability of acquiring a company using significant debt, while projecting potential returns.

This guide breaks down the mechanics, applications, and nuances of LBO models.

What is an LBO Model?

An LBO model is used to evaluate the feasibility of a leveraged buyout - a transaction where a company is acquired primarily using debt.

The goal is to determine if the target company can generate sufficient cash flow to repay the debt and deliver attractive returns to equity investors.

It is a financial model, used to evaluate the acquisition of a company using a significant amount of debt. The model helps private equity firms estimate how much they can pay for a company, how much debt they can use, and what financial returns (internal rate of return, or IRR) they might achieve if they buy, improve, and later sell the company.

The LBO model projects the company’s future financial performance, tracks how debt is paid down over time, and calculates the potential profit for investors at exit, factoring in both the company’s growth and the effect of leverage. The main goal is to determine whether the deal will generate attractive returns for the equity investors by using debt to boost those returns.

Why It Matters:

- Debt-Driven Acquisitions: Typically, 50-90% of the purchase price is financed through debt.

- Focus on Cash Flow: The model emphasizes the target’s ability to service debt through operational cash flow.

- Exit-Driven Strategy: Returns hinge on selling the company (e.g., IPO, strategic sale) after improving profitability.

Why Use LBO Models?

- Deal Viability: Assess if the target’s cash flows can support debt obligations.

- Pricing Strategy: Determine the maximum affordable purchase price while achieving target IRRs (often 20%+).

- Debt Optimization: Balance debt types (senior vs. subordinated) to minimize costs and risks.

- Scenario Analysis: Stress-test assumptions (e.g., recession impacts) to gauge resilience.

Benefits vs. Limitations

Benefits

- Structured Decision-Making: Provides a quantitative framework for high-risk investments.

- Cash Flow Focus: Highlights the importance of operational efficiency and cost management.

- Flexibility: Models can adapt to various industries and economic conditions.

Limitations

- Assumption Sensitivity: Overly optimistic projections can skew results.

- Complexity: Requires expertise in financial modeling and debt structuring.

- Market Risks: Unforeseen factors (e.g., interest rate hikes) may disrupt projections.

How Leverage Magnifies Returns

1. The Magnification Effect

When a PE firm acquires a company, they typically contribute a portion of their own equity and finance the rest with debt. If the acquired company performs well and its value increases, the return on the PE firm's equity investment is significantly amplified.

Here's a simplified example:

- Scenario A (No Leverage): A PE firm buys a company for $100 million using $100 million of its own equity. If the company sells for $150 million, the profit is $50 million, a 50% return on equity.

- Scenario B (With Leverage): A PE firm buys the same company for $100 million, using $20 million of its own equity and $80 million in debt. If the company still sells for $150 million, the profit is still $50 million. However, after paying back the $80 million debt, the PE firm is left with $70 million from its initial $20 million equity investment. This represents a 250% return on equity ($50 million profit / $20 million equity).

As you can see, the profit is the same in both scenarios, but the return on the PE firm's invested capital is dramatically higher when leverage is employed. This magnification effect is central to generating the outsized returns that PE investors seek.

2. Enhancing Capital Efficiency

By using leverage, PE firms can acquire larger companies or more companies with the same amount of their own committed capital.

This allows them to deploy their funds more efficiently across a broader portfolio of investments, potentially diversifying risk and increasing the overall scale of their operations.

Without leverage, they would be limited to much smaller acquisitions or would need to raise significantly more equity for each deal, which can be time-consuming and dilute returns.

3. Lowering the Overall Cost of Capital

In many cases, debt financing is cheaper than equity financing.

Interest payments on debt are often tax-deductible, further reducing the effective cost. While equity investors expect a higher rate of return to compensate for the greater risk they undertake, lenders are content with a fixed interest payment.

By strategically blending debt and equity, PE firms can lower their overall cost of capital for an acquisition, making the investment more financially attractive.

4. Disciplining Management and Driving Operational Improvements

The presence of debt can act as a powerful motivator for the management team of an acquired company.

With significant debt obligations, there's increased pressure to generate strong cash flow and improve operational efficiency to service that debt. This financial discipline often encourages management to identify and implement cost-cutting measures, streamline operations, and focus on core revenue-generating activities.

PE firms frequently bring in their own operational experts to work alongside management, further accelerating these improvements.

5. Facilitating Distributions and Recapitalizations

Leverage also offers flexibility during the life of the investment. Once a company has improved its financial performance and generated stable cash flows, PE firms can sometimes undertake a dividend recapitalization.

This involves issuing new debt to pay a dividend to the PE firm and its investors, effectively returning some of their initial investment while still holding the company. This allows PE firms to realize partial returns before a full exit, providing liquidity to their limited partners.

The Risks and Rewards

While the benefits of leverage are clear, it's crucial to acknowledge the inherent risks.

High levels of debt can amplify losses if an investment performs poorly. If a company struggles to generate sufficient cash flow, it can face difficulties servicing its debt, potentially leading to default or bankruptcy.

This is why PE firms conduct extensive due diligence and often implement conservative financial covenants with their lenders.

Key Drivers of Return

1. Buy at an Attractive Price (The Foundation of Value)

The journey to strong returns begins with the acquisition itself. Private equity firms are highly skilled in identifying companies that are undervalued or have significant untapped potential. This isn't about simply finding cheap companies; it's about discerning value where others may not. Key aspects of this driver include:

- Rigorous Due Diligence: PE firms conduct exhaustive analysis of a target company's financials, market position, management team, operational efficiency, and competitive landscape. This deep dive helps them uncover hidden risks and opportunities.

- Proprietary Deal Sourcing: The best PE firms don't just wait for investment banks to present deals. They actively build relationships, conduct proactive outreach, and develop sector expertise to unearth attractive opportunities that may not be widely marketed. This proprietary deal flow often allows them to acquire companies at more favorable valuations.

- Industry and Sector Focus: Many PE firms specialize in particular industries (e.g., tech, healthcare, industrials). This specialization gives them a deeper understanding of market dynamics, competitive advantages, and potential for growth, enabling them to make more informed investment decisions and spot mispriced assets.

- Carve-outs and Special Situations: PE firms often find value in corporate carve-outs (when a large company sells off a non-core division) or distressed situations. These scenarios can present opportunities to acquire strong assets at a discount due to the seller's specific circumstances or market inefficiencies.

By acquiring companies at a sensible or even discounted valuation relative to their intrinsic potential, PE firms build in a margin of safety and a strong starting point for value creation.

2. Grow the Business or Operationally Improve (The Core of Value Creation)

Once acquired, the focus shifts to actively transforming the company to enhance its performance and value. This is where the private aspect of private equity truly shines, as firms have direct control and a long-term perspective that public markets often lack. This driver encompasses:

- Operational Enhancements: This is a broad category, but it boils down to making the business run better, faster, and more profitably. This can include:

- Cost Optimization: Streamlining processes, renegotiating supplier contracts, improving supply chain efficiency, and eliminating redundant expenses.

- Revenue Growth Initiatives: Investing in sales and marketing, expanding into new geographies or product lines, developing new distribution channels, and optimizing pricing strategies.

- Talent and Leadership: Bringing in seasoned executives or strengthening existing management teams, aligning incentives, and fostering a performance-driven culture.

- Technological Transformation: Implementing new IT systems, automation, or data analytics to improve efficiency, decision-making, and customer experience.

- Strategic Restructuring: Divesting non-core assets that don't fit the long-term vision, consolidating business units, or reorganizing the company to improve focus and agility.

- Buy-and-Build Strategies: This involves acquiring a strong platform company and then making several smaller, complementary add-on acquisitions. This strategy allows PE firms to achieve economies of scale, expand market reach, consolidate fragmented industries, and create significant synergies.

These operational and strategic improvements directly lead to increased profitability (higher EBITDA), stronger cash flow generation, and often, faster revenue growth.

3. Leverage (The Amplifier of Returns)

While the first two drivers are about creating fundamental value, leverage is about magnifying the returns on the PE firm's equity investment.

It acts as a powerful amplifier, making good investments even better. As detailed in the previous section, the reasons PE firms use leverage include:

- Amplifying Returns (The Magnification Effect): By using a smaller equity cheque and larger debt, any increase in the company's value translates into a disproportionately higher return on the PE firm's invested capital.

- Enhancing Capital Efficiency: Leverage allows PE firms to acquire larger assets or a greater number of companies with a finite amount of their own capital, leading to more efficient deployment of funds.

- Lowering the Overall Cost of Capital: Debt is often cheaper than equity, and its interest payments are typically tax-deductible, reducing the blended cost of financing an acquisition.

- Disciplining Management and Driving Operational Improvements: The pressure of debt obligations incentivizes management to prioritize cash flow generation and operational efficiency.

- Facilitating Distributions and Recapitalizations: Stable cash flows can allow for debt paydown or dividend recapitalizations, returning capital to investors before a full exit.

It's the synergy between acquiring at an attractive price, actively improving the business, and strategically applying leverage that forms the core of private equity's value creation model.

Each component plays a crucial role in the pursuit of superior risk-adjusted returns for investors.

What Makes a Good Leveraged Buyout (LBO) Candidate?

1. Strong, Stable, and Predictable Cash Flows

This is arguably the most critical factor. An LBO relies heavily on the target company's ability to generate sufficient cash flow to service the significant debt burden taken on during the acquisition.

Companies with strong, stable, and predictable cash flows can:

- Service Debt: Consistently make interest payments and principal repayments on time.

- Fund Operations: Cover ongoing operational expenses without stress.

- Invest in Growth: Have surplus cash to reinvest in the business for organic growth or strategic initiatives.

- Weather Economic Downturns: Maintain cash flow generation even during less favorable economic conditions, providing a buffer against unforeseen challenges.

Industries known for stable cash flows often include essential services, mature consumer goods, and certain infrastructure-related businesses.

2. Low Capital Expenditure (CapEx) Requirements

Companies that require minimal ongoing capital investment (CapEx) to maintain or grow their operations are highly attractive.

Lower CapEx means more free cash flow available to pay down debt. Businesses that are asset-heavy or require continuous, significant investment in plant, property, and equipment (PP&E) are generally less appealing LBO candidates because their cash flow is tied up in sustaining assets rather than servicing debt.

3. Strong and Defensible Market Position

A company with a leading or defensible market position (e.g., high market share, strong brand recognition, proprietary technology, high barriers to entry) offers several advantages:

- Pricing Power: Ability to command premium prices or resist price erosion from competitors.

- Stable Revenue: Reduced vulnerability to competitive pressures and market volatility.

- Predictable Earnings: Greater certainty in future financial performance.

- Customer Loyalty: A loyal customer base provides a reliable revenue stream.

Monopolies, oligopolies, or businesses with unique intellectual property often fit this description.

4. Opportunities for Operational Improvement

While cash flow stability is key, PE firms also look for companies where they can actively create value by improving operations. This might involve:

- Inefficiencies: Identifying areas where costs can be cut, processes optimized, or productivity enhanced.

- Underperforming Assets/Divisions: Opportunities to divest non-core or struggling parts of the business.

- Under-leveraged Growth Potential: Companies that haven't fully exploited market opportunities or expanded into new areas due to lack of capital or strategic focus.

- Sub-optimal Management: Situations where bringing in new, more experienced management can unlock significant value.

The fixer-upper aspect is often where PE firms demonstrate their operational expertise and drive substantial value.

5. Clear Exit Strategy

Before even acquiring a company, PE firms typically have a strong idea of how they will eventually sell it to realize their return. A clear exit strategy could involve:

- Strategic Buyer: Selling to a larger corporation in the same industry looking for market share, technology, or synergies.

- Initial Public Offering (IPO): Taking the company public, though this is less common and depends heavily on market conditions.

- Secondary Buyout: Selling to another private equity firm.

The attractiveness of potential buyers and the overall M&A environment are important considerations.

6. Experienced and Motivated Management Team (or Potential for One)

While PE firms often bring in new leadership, an existing strong management team that is willing to partner with the new owners and is incentivized to drive value can significantly contribute to success.

Alternatively, the potential to recruit a highly capable management team if the existing one is not suitable is also a positive sign.

7. Clean Balance Sheet (or Easily Fixable)

A relatively clean balance sheet with manageable existing debt levels and few contingent liabilities (e.g., pending lawsuits, environmental issues) is preferred.

This provides the PE firm with more flexibility to layer on new acquisition debt without immediately overleveraging the company. If there are existing issues, they should be clearly identifiable and resolvable.

8. Non-Cyclical Industry Exposure

Companies operating in non-cyclical industries (i.e., less sensitive to economic booms and busts) are generally preferred.

This again relates to the need for stable and predictable cash flows, which are harder to achieve in highly cyclical sectors that experience significant revenue fluctuations with economic cycles.

By targeting companies that exhibit a combination of these characteristics, private equity firms mitigate risk and increase the probability of a successful leveraged buyout, demonstrating that their investment strategy is far more nuanced than simply piling on debt.

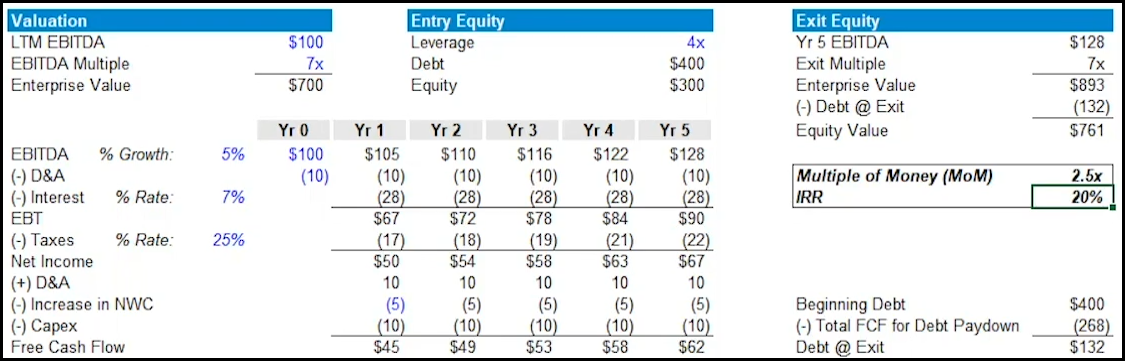

Example: Simple LBO Model

Conclusion

LBO models are the backbone of private equity, enabling investors to quantify risk and reward in debt-heavy acquisitions.

While they offer a rigorous framework, their success depends on realistic assumptions and a deep understanding of the target’s operations.

Mastering LBO modeling is not just about crunching numbers - it’s about envisioning a company’s potential and strategically unlocking value.

Next: Click for a Step-by-Step Walkthrough: https://www.myfinanceprocess.com/building-an-lbo-model-a-step-by-step-walkthrough/