The Post-Merger Integration Playbook: How Strategy Frameworks Turn M&A Deals into Real Value

Mergers and acquisitions remain one of the most powerful, and perilous, levers for corporate growth. Boards approve deals to accelerate market entry, acquire capabilities, and unlock economies of scale. Yet history is unforgiving: between 70% and 90% of mergers fail to achieve their intended value, despite rigorous due diligence and sophisticated valuation models.

The reason is not mysterious. Value is not created at signing. It is created, or destroyed, during post-merger integration (PMI).

Post-merger integration is the moment where strategic ambition collides with operational reality. Two organizations with different cultures, systems, incentives, and leadership styles must rapidly become one - without disrupting customers, losing talent, or eroding financial performance.

This complexity explains why PMI is now recognized as the single most important determinant of M&A success.

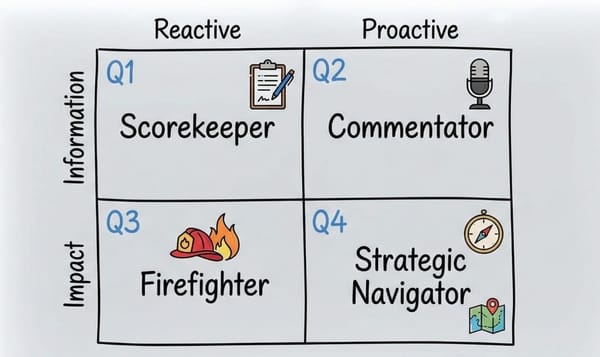

A Post-Merger Integration Playbook provides the discipline required to navigate this complexity. It transforms a one-time transaction into a repeatable capability, allowing organizations to move beyond reactive integration toward a structured, value-driven execution model.

Why Most M&A Deals Fail at the Integration Stage

The core paradox of M&A is that deals are evaluated with analytical precision, while integration is often managed with improvisation.

Common integration failure modes include:

- Lack of clarity on how synergies will be delivered

- Functional silos executing disconnected plans

- Delayed decision-making due to unclear governance

- Cultural clashes that undermine productivity and trust

- IT integration delays that paralyze operations

Successful acquirers explicitly recognize that PMI is a transformation program, not an administrative exercise.

Integration Governance: Designing the Control System for PMI

Governance is the operating system of integration. Without it, even the most compelling deal logic collapses under execution friction.

The Strategic Role of the Integration Management Office (IMO)

At the center of integration governance is the Integration Management Office (IMO). Unlike a traditional PMO, the IMO is a value-focused leadership body, not merely a tracking function.

The IMO is responsible for:

- Translating the deal thesis into measurable integration objectives

- Sequencing integration initiatives to protect business continuity

- Managing interdependencies across functions

- Tracking synergy realization against financial commitments

- Escalating risks before they become value-destructive

An effective IMO operates with executive sponsorship and decision authority - not as a reporting layer, but as the integrator of the entire enterprise.

Governance Components and Their Responsibilities

| Component | Strategic Role | Core Outputs |

|---|---|---|

| Steering Committee | Strategic direction and trade-off decisions | Integration priorities, capital allocation |

| Integration Management Office | Central coordination and value tracking | Synergy dashboards, milestone governance |

| Functional Workstreams | Tactical execution within functions | Detailed workplans, dependency maps |

| Clean Teams | Pre-close analysis within regulatory limits | Synergy validation, Day 1 planning |

| Change Management Team | Cultural and behavioral integration | Communication strategy, engagement metrics |

Best-in-class acquirers mobilize these structures during diligence, ensuring that assumptions made during valuation are executable in practice.

The Post-Merger Integration Lifecycle: From Planning to Stabilization

PMI unfolds across a structured lifecycle, with each phase demanding different leadership behaviors and priorities.

Phase 1: Pre-Close Planning and Synergy Validation

The period between signing and close is the most leverageable, and often the most neglected, phase of integration.

Key objectives include:

- Defining the integration thesis (how the deal creates value)

- Prioritizing value drivers and critical risks

- Validating synergies with operational realism

The W-Shaped Synergy Approach

Leading acquirers use a W-shaped methodology to align ambition with accountability:

- Top-down ambition: Leadership defines value targets

- Bottom-up validation: Functional teams pressure-test assumptions

- Final alignment: Targets are reset to stretch yet achievable levels

This process ensures ownership rests with those accountable for delivery, not just those who approved the deal.

Phase 2: Day 1 Readiness - Protecting the Base Business

Day 1 is not about transformation. It is about control and confidence.

The goal is continuity: customers see no disruption, employees know where to go, and regulators see compliance.

Critical Day 1 priorities include:

- Legal entity and financial control transfer

- Payroll, benefits, and system access continuity

- Unified internal and external communications

- Customer-facing stability (billing, support, account ownership)

Transition Service Agreements (TSAs) often bridge gaps while longer-term integration proceeds - but they must be actively managed to avoid dependency traps.

Phase 3: The First 100 Days - From Stability to Momentum

The first 100 days determine whether an integration accelerates or stagnates.

This phase focuses on:

- Delivering early quick wins that validate the deal logic

- Launching longer-term transformation initiatives

- Resolving leadership roles, reporting lines, and decision rights

- Conducting deep cultural and capability assessments

Delayed decisions during this phase create uncertainty - one of the strongest predictors of voluntary talent attrition.

Organizational Alignment Through the McKinsey 7S Framework

One of the most powerful diagnostic tools in PMI is the McKinsey 7S Framework.

Hard Elements: Strategy, Structure, Systems

- Strategy: The combined entity must articulate a unified competitive positioning. Conflicting strategies (e.g., cost leadership vs. differentiation) lead to brand dilution and internal conflict.

- Structure: Integration requires decisive choices on organizational design, spans of control, and role duplication.

- Systems: IT, financial reporting, CRM, and operational systems must support the new strategy - not simply coexist.

Soft Elements: Shared Values, Skills, Style, Staff

- Shared Values: Cultural incompatibility is one of the most cited causes of deal failure.

- Skills: The risk is not redundancy - it is losing the secret sauce capabilities that justified the acquisition.

- Style: Leadership behaviors set the tone for the entire integration.

- Staff: Retention of critical talent determines whether value is sustained or eroded.

The framework highlights a core insight: integration is systemic. Changes in one dimension cascade across the others.

Value Chain Integration: Where Synergies Are Actually Captured

While the 7S model focuses on internal alignment, Value Chain Analysis, identifies where integration creates competitive advantage.

Primary Activities: Revenue Synergies

- Operations: Facility consolidation and process optimization

- Marketing & Sales: Cross-selling, bundling, and pricing harmonization

- Logistics: Network optimization and inventory rationalization

Support Activities: Cost and Capability Synergies

- Procurement: Supplier consolidation and renegotiation

- Technology Development: Integrated R&D and faster innovation cycles

- Firm Infrastructure: Shared services and overhead rationalization

Mapping the value chain enables the IMO to design a coherent Target Operating Model (TOM) rather than a patchwork organization.

Financial Synergies: From Target Setting to Realization

Financial synergies fall into three categories:

Cost Synergies

- Redundancy elimination

- Shared services consolidation

- Procurement savings

These are typically realized within 12–24 months and are the most predictable.

Revenue Synergies

- Cross-selling and market expansion

- Pricing optimization

- Product bundling

Revenue synergies are harder to forecast and often take twice as long to materialize.

Financial and Tax Synergies

- Lower cost of capital through scale

- Improved access to financing

- Utilization of tax attributes

Crucially, synergy value must be assessed net of integration costs and timing risk, not as headline numbers.

IT Integration: The Longest Critical Path

IT integration often determines the overall integration timeline.

A phased IT roadmap typically includes:

- Day 1 operational stability

- Collaboration and identity management

- Application rationalization

- Target-state architecture design

- ERP and core system consolidation

ERP integration is particularly high-risk. Data quality failures can undermine financial reporting, compliance, and decision-making.

Cloud-based platforms increasingly enable faster, more flexible integration - but only when paired with disciplined data governance.

The Human Element: Change Management and Culture

Cultural misalignment accounts for approximately 41% of failed deals.

Frameworks such as the ADKAR model provide structure for managing individual transitions:

- Awareness: Why the deal matters

- Desire: What it means for me

- Knowledge: How roles and processes change

- Ability: Training and enablement

- Reinforcement: Incentives and recognition

Retention strategies must focus on Revenue Drivers and Knowledge Keepers, whose departure permanently destroys value.

Monitoring Integration Progress with the Balanced Scorecard

The Balanced Scorecard ensures integration success is measured holistically - not just financially.

Key perspectives include:

- Financial: Synergy realization, integration costs

- Customer: Churn, satisfaction, NPS

- Internal Processes: Integration velocity and efficiency

- Learning & Growth: Engagement, retention, capability building

Cascading these metrics across workstreams aligns daily execution with strategic intent.

AI and Digital Tools: The New PMI Advantage

AI is rapidly reshaping PMI execution by enabling:

- Automated data harmonization

- Cultural sentiment analysis using NLP

- Contract and risk scanning

- Real-time synergy dashboards

As deal timelines compress, AI-enabled integration is becoming a differentiator.

Transformational M&A: Integrating While Reinventing

Modern M&A increasingly targets capability and business model transformation, not just scale.

These scope deals require a transform-as-you-transact mindset - embedding technology upgrades and organizational redesign into the integration itself.

Traditional linear playbooks must evolve into adaptive, non-linear integration models that balance speed with reinvention.

Making Integration a Core Capability

Post-merger integration is where strategy becomes reality.

Organizations that treat PMI as a repeatable, framework-driven capability, supported by strong governance, disciplined execution, cultural rigor, and modern technology, consistently outperform their peers.

In an era of accelerating deal activity and rising complexity, integration excellence is the defining capability that separates deal-makers from value creators.

Frequently Asked Questions (FAQ) About Post-Merger Integration (PMI)

What is post-merger integration (PMI)?

Post-merger integration (PMI) is the structured process of combining two organizations after a merger or acquisition to realize the deal’s intended value.

It includes aligning strategy, operations, systems, culture, and talent to ensure the combined entity operates as a single, high-performing organization.

Why do most mergers fail during integration?

Most mergers fail because integration is underplanned and under-governed. Common causes include unclear decision rights, unrealistic synergy targets, cultural misalignment, delayed IT integration, and the loss of key talent. While deal modeling is rigorous, execution discipline during PMI is often lacking.

What is a post-merger integration playbook?

A post-merger integration playbook is a repeatable, framework-driven guide that defines how an organization plans, governs, and executes integration.

It translates the deal thesis into actionable workstreams, timelines, metrics, and decision structures - reducing risk and increasing the likelihood of value realization.

What does an Integration Management Office (IMO) do?

The Integration Management Office (IMO) acts as the central command center for PMI. It coordinates cross-functional workstreams, manages interdependencies, tracks synergy realization, escalates risks, and ensures integration activities remain aligned with the deal’s strategic objectives.

Unlike a traditional PMO, an IMO is value-focused, not just schedule-focused.

When should integration planning begin?

Integration planning should begin during due diligence, not after deal close. Leading acquirers treat diligence as the first phase of integration, ensuring that synergy assumptions, operating model choices, and cultural risks are validated before the transaction is finalized.

What happens on Day 1 of a merger?

Day 1 marks the legal close of the transaction and the transfer of control. The primary objective is business continuity, not transformation. This includes uninterrupted customer service, payroll accuracy, system access, regulatory compliance, and clear communication to employees and customers.

What are the most important priorities in the first 100 days post-merger?

The first 100 days focus on building momentum while maintaining stability. Key priorities include delivering quick wins, resolving leadership and reporting structures, launching synergy initiatives, conducting cultural diagnostics, and retaining critical talent.

This period often determines long-term integration success or failure.

How are synergies measured and tracked during PMI?

Synergies are tracked through a combination of financial modeling, operational KPIs, and governance dashboards managed by the IMO.

Best practices include separating one-time integration costs from recurring benefits, assigning clear owners to each synergy initiative, and measuring performance against time-phased targets.

Why is culture such a major risk in post-merger integration?

Culture shapes how decisions are made, how conflict is resolved, and how employees respond to change.

Cultural clashes, such as entrepreneurial versus hierarchical norms, can erode trust, slow execution, and drive talent attrition. Structured change management frameworks, such as the ADKAR model, help mitigate these risks.

What role does IT play in post-merger integration?

IT integration is often the longest and highest-risk component of PMI. It underpins financial reporting, customer operations, cybersecurity, and employee productivity. Poor data migration or delayed system integration can disrupt operations and undermine synergy realization.

As a result, IT integration often defines the critical path for the entire merger.

How long does post-merger integration usually take?

While Day 1 and the first 100 days receive the most attention, full integration typically takes 12 to 36 months, depending on deal complexity, regulatory constraints, and transformation scope. Revenue synergies often take longer to materialize than cost synergies.

How is AI changing post-merger integration?

AI is increasingly used to accelerate PMI by automating data harmonization, analyzing cultural sentiment, identifying contractual risks, and generating real-time synergy dashboards. Organizations that embed AI into their integration workflows gain speed, insight, and execution discipline.

What is the difference between traditional and transformational M&A integration?

Traditional integrations focus on scale and cost reduction, while transformational integrations aim to acquire new capabilities, enter new markets, or reinvent business models.

Transformational deals require a transform-as-you-transact approach, embedding change into the integration itself rather than delaying it.

What makes post-merger integration successful?

Successful PMI combines:

- Clear integration governance and decision rights

- A strong Integration Management Office

- Realistic, owned synergy targets

- Disciplined IT and operational execution

- Rigorous change management and talent retention

- Continuous performance monitoring

Ultimately, integration success depends less on deal size and more on execution discipline.