Top-Down vs. Bottom-Up Forecasting

Whether it's anticipating next quarter's sales, projecting market demand for a new product, or planning resource allocation, accurate forecasting is the bedrock of sound strategic decision-making.

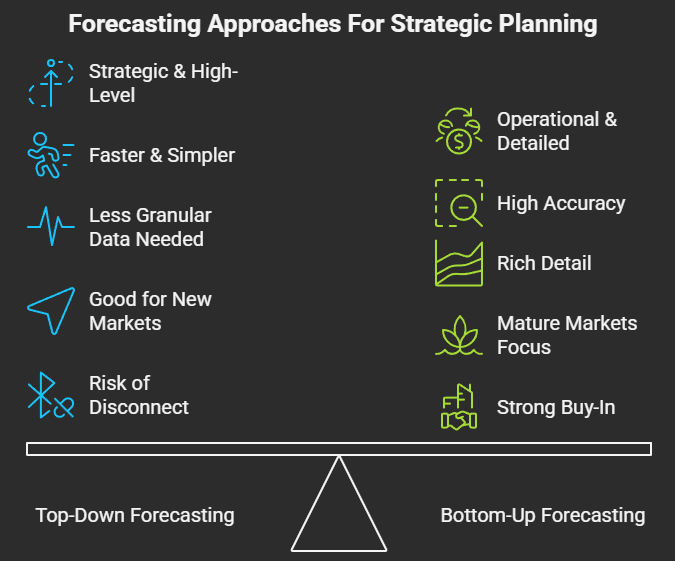

There are two primary methodologies for forecasting: Top-Down Forecasting and Bottom-Up Forecasting.

While both aim to predict the future, they approach the task from fundamentally different starting points.

Top-Down Forecasting: The Macro View

Top-down forecasting begins with a broad, aggregate prediction for the entire market or company, which is then disaggregated down to specific segments, products, or units.

How it works:

- Macro-level estimation: Start with an overall market forecast (e.g., total industry sales, GDP growth, or a company's total revenue). This often involves external market research, economic indicators, historical company performance trends, and senior management's strategic vision.

- Allocation/Disaggregation: This aggregate number is then broken down and allocated to lower levels of the organization (e.g., total company sales are broken down by region, then by product line, then by individual store or sales team). This allocation often uses ratios, percentages, or proportional historical data.

Key Characteristics:

- Strategic & High-Level: Often driven by senior leadership, market analysts, and external economic data.

- Faster & Simpler (initially): Easier to get a quick, overarching forecast.

- Good for new markets/products: Useful when detailed historical data at lower levels isn't available.

- Risk of disconnect: Can sometimes lack the granular detail and ground-level reality.

When to use it:

- Strategic planning and target setting: When setting overall company goals or entering entirely new markets.

- Economic analysis: When external factors are the primary drivers of performance.

- New product launches (early stages): Estimating total market potential before granular sales data exists.

- High-level budget allocation: Distributing financial resources across broad categories.

Advantages:

- Efficiency: Can provide quick estimates for large organizations or markets.

- Strategic Alignment: Ensures forecasts align with overall company objectives and market outlook.

- Less granular data needed: Useful when detailed operational data is scarce.

- Broader perspective: Incorporates macroeconomic trends and competitive landscape.

Disadvantages:

- Lack of Detail/Accuracy at lower levels: Can miss critical operational nuances or local market specificities.

- Reliance on Assumptions: Heavily depends on the validity of high-level assumptions, which if incorrect, can significantly skew the entire forecast.

- Potential for disconnect: Front-line teams might feel their realities aren't reflected, leading to lower buy-in.

- Stretch goals vs. Reality: Sometimes top-down targets can be overly optimistic if not grounded in bottom-up feasibility.

Bottom-Up Forecasting: The Granular View

Bottom-up forecasting starts with detailed estimates from the lowest levels of the organization, which are then aggregated upwards to form an overall forecast. It's like examining each individual tree first, then building up to understand the entire forest.

How it works:

- Unit-level estimation: Individual teams, sales representatives, product managers, or store managers predict their specific sales, demand, or required resources. This involves considering customer interactions, current pipeline, local market conditions, specific product features, and operational capacity.

- Aggregation: These individual forecasts are then rolled up and consolidated through different organizational layers (e.g., individual sales forecasts aggregated to a regional total, then to a national total, and finally to a company-wide forecast).

Key Characteristics:

- Operational & Detailed: Driven by front-line staff and operational data.

- More time-consuming: Requires gathering and consolidating many individual estimates.

- High accuracy at granular level: Captures ground-level realities.

- Strong buy-in: Teams are more committed to targets they helped create.

When to use it:

- Operational planning and scheduling: Production planning, inventory management, staffing.

- Detailed sales projections: For specific products, territories, or customer segments.

- Resource budgeting: Estimating specific department or project costs.

- Mature markets/products: Where historical transactional data is rich and reliable.

Advantages:

- High Accuracy: Reflects actual market conditions and operational capabilities more accurately at a granular level.

- Increased Buy-in & Accountability: Teams are more invested in achieving forecasts they helped create.

- Identifies Bottlenecks: Highlights potential capacity constraints or resource needs at the operational level.

- Rich Detail: Provides insights into specific product performance, customer segments, or regional variations.

Disadvantages:

- Time-Consuming: Can be a lengthy and resource-intensive process to collect and aggregate data.

- Potential for Bias: Individual teams might inflate or deflate forecasts based on perceived incentives or disincentives.

- Misses Macro Trends: Can overlook broader market shifts or economic downturns that individual teams might not perceive.

The Power of Combination: A Hybrid Approach

The most effective forecasting strategies often involve a hybrid approach, blending the strengths of both top-down and bottom-up methodologies.

- Start Top-Down, Validate Bottom-Up: Senior management sets ambitious yet realistic top-down targets based on market potential and strategic goals. These targets are then shared with operational teams, who build bottom-up forecasts. Any significant discrepancies between the two are then investigated and reconciled through a collaborative discussion and adjustment process.

- Scenario Planning: Use top-down for what-if scenarios related to macroeconomic changes, and bottom-up to assess the operational impact of those scenarios.

- Iterative Process: Forecasting should rarely be a one-time event. An iterative loop where top-down guidance informs bottom-up detail, and bottom-up insights refine top-down assumptions, generally yields the most accurate and actionable forecasts.

Why a Hybrid Approach Works Best:

This integrated method provides the strategic vision and market perspective of top-down forecasting while ensuring the operational realism and team buy-in of bottom-up forecasting.

It fosters communication between different levels of the organization and builds a more robust, defensible forecast.

Tools and Techniques, and the Impact of Industry

While the concepts of top-down and bottom-up forecasting are clear, their practical application and the optimal balance between them can vary significantly based on the industry and the nature of the business itself.

For Top-Down Forecasts: Strategy teams often employ techniques like regression analysis (correlating company performance with macroeconomic indicators like GDP, interest rates, or consumer spending), market sizing studies to estimate total addressable market (TAM), and management consensus sessions where executive insights, strategic goals, and high-level market intelligence shape the overall outlook. This approach is particularly prevalent in:

- New Ventures/Startups: When there's little to no historical data, market sizing from a top-down perspective (e.g., If we capture 1% of this $10 billion market...) is often the only way to forecast.

- Highly Dynamic or Disruptive Industries: Where rapid technological shifts or new business models mean past performance is a poor indicator of future results.

- Companies Driven by Macro-Economic Factors: Industries like construction, automotive, or luxury goods that are highly sensitive to GDP, inflation, or consumer confidence often lean on top-down macro forecasts.

For Bottom-Up Forecasts: Operational teams leverage detailed data from Customer Relationship Management (CRM) systems to analyze sales pipelines and customer probabilities, Enterprise Resource Planning (ERP) systems for granular historical transaction data, and specific capacity planning tools to understand production limits, staffing levels, and material availability. This approach is more dominant in:

- Mature Manufacturing and Production-Heavy Industries: Where production capacity, inventory levels, and detailed sales channels are well-established and predictable. Forecasts are built from machine output, shift planning, and direct order books.

- Retail and Consumer Goods (Store/SKU Level): Forecasting individual store traffic, product sell-through, and inventory needs is inherently a bottom-up exercise based on past sales, promotions, and local events.

- Service Industries with Defined Project Pipelines: Consulting firms, advertising agencies, or construction companies often build forecasts based on individual project wins, estimated project durations, and resource allocation.

Conclusion

Forecasting is less about predicting the exact future and more about building a robust framework for informed decision-making.

Top-down forecasting offers a crucial strategic lens, providing the big picture and overall direction. Bottom-up forecasting grounds predictions in operational reality and fosters accountability.

By combining these two approaches, businesses can develop forecasts that are not only accurate but also actionable, adaptable, and aligned across the entire organization.