The Investor's Guide to Top US Economic News Events: Annual Calendar

As an investor, staying ahead of market-moving US economic news events can be the difference between proactive decision-making and reactive losses. Interest rate decisions, inflation data, and employment reports regularly trigger sharp moves across stocks, bonds, currencies, and commodities.

This guide breaks down the most important US economic calendar events, explains why they matter, and shows how investors can position portfolios around them.

Why US Economic News Matters for Investors

Economic data shapes expectations around:

- Monetary policy (interest rates and liquidity)

- Corporate earnings and profit margins

- Consumer behavior and spending trends

- Market volatility and risk sentiment

Markets don’t just react to the data itself - they react to surprises versus expectations. That’s why understanding what to watch is just as important as knowing when it’s released.

Federal Reserve Events (Highest Market Impact)

Federal Open Market Committee (FOMC) Meetings

Frequency: 8 times per year

Market Impact: Extremely High

FOMC meetings determine:

- The federal funds rate

- Forward guidance on inflation and growth

- The overall direction of monetary policy

Key components investors watch:

- Interest rate decision

- Policy statement wording

- Fed Chair press conference

- Dot plot projections (quarterly)

- Summary of Economic Projections (quarterly)

Investor takeaway:

Even small changes in language about inflation or employment can move equity indices, Treasury yields, and the US dollar within minutes.

Jackson Hole Economic Symposium

Timing: Late August

Market Impact: Very High

This annual event often previews major policy shifts before they appear in official decisions.

Why it matters:

- Less formal environment → more candid policy signaling

- Historically linked to major Fed pivots

- Heavily scrutinized by global markets

Inflation Indicators (Policy Drivers)

Consumer Price Index (CPI)

Frequency: Monthly

Market Impact: Very High

Measures price changes consumers experience directly.

Key metrics:

- Headline CPI (YoY)

- Core CPI (excludes food & energy)

- Month-over-month trends

- Services vs. goods inflation

Investor insight:

Hot CPI prints typically pressure equities and bonds while boosting rate-sensitive assets.

Producer Price Index (PPI)

Frequency: Monthly

Market Impact: High

Tracks inflation at the wholesale level.

Why investors care:

PPI often acts as a leading indicator for CPI, especially for goods-heavy sectors.

Personal Consumption Expenditures (PCE) Price Index

Frequency: Monthly

Market Impact: Very High

The Fed’s preferred inflation gauge.

Focus point:

Core PCE trends matter more for long-term policy direction than short-term CPI volatility.

Employment Data (Economic Momentum)

Nonfarm Payrolls (NFP)

Timing: First Friday of each month

Market Impact: Very High

Includes:

- Job creation/losses

- Unemployment rate

- Labor force participation

- Wage growth

- Revisions to prior months

Trading impact:

Often causes sharp intraday swings in equities, bonds, and currencies.

Weekly Initial Jobless Claims

Frequency: Weekly

Market Impact: Moderate to High

Provides near-real-time insight into labor market stress.

Investor use:

Early warning signs of economic slowdowns or labor market deterioration.

Economic Growth Indicators

Gross Domestic Product (GDP)

Frequency: Quarterly

Market Impact: High

Tracks total economic output.

Most important reading:

The advance estimate, markets price it in fastest.

ISM Manufacturing & Services PMI

Frequency: Monthly

Market Impact: High

- Above 50 = expansion

- Below 50 = contraction

Why PMIs matter:

They are leading indicators, often signaling turning points before GDP data confirms them.

Consumer Spending & Confidence

Retail Sales

Frequency: Monthly

Market Impact: High

Since consumers drive ~70% of US economic activity, this data strongly influences growth expectations.

Watch closely:

- Core retail sales

- Control group data

- Seasonal adjustments

Consumer Confidence Index

Frequency: Monthly

Market Impact: Moderate to High

Divergences between current conditions and future expectations often signal upcoming economic shifts.

Housing Market Indicators

Housing Starts & Building Permits

Frequency: Monthly

Market Impact: Moderate

Highly sensitive to interest rates and financing conditions.

Existing Home Sales

Frequency: Monthly

Market Impact: Moderate

Provides insight into:

- Inventory levels

- Price trends

- Consumer balance sheet health

Annual US Economic Events Calendar

Q1

- January: Fed Chair testimony to Congress

- February: Semiannual Monetary Policy Report

- March: FOMC meeting with projections

Q2

- April–June: GDP releases and revisions

- May: FOMC meeting

- June: FOMC meeting + projections

Q3

- July: FOMC meeting

- August: Jackson Hole Symposium

- September: FOMC meeting + projections

Q4

- October: Initial Q3 GDP reading

- November: FOMC meeting

- December: Final FOMC meeting + projections

Key Data Sources & Tools

Primary Sources

- Federal Reserve Economic Data (FRED)

- Bureau of Labor Statistics

- Bureau of Economic Analysis

- Conference Board

Investor Dashboard Metrics

- Fed funds rate expectations

- 2-year & 10-year Treasury yields

- US Dollar Index (DXY)

- Volatility Index (VIX)

Turning Economic News into an Edge

Successfully navigating US economic news requires preparation, context, and discipline. Markets don’t reward raw data, they reward understanding how that data changes expectations.

By tracking these key economic events, comparing results against forecasts, and managing risk thoughtfully, investors can turn volatility into opportunity rather than uncertainty.

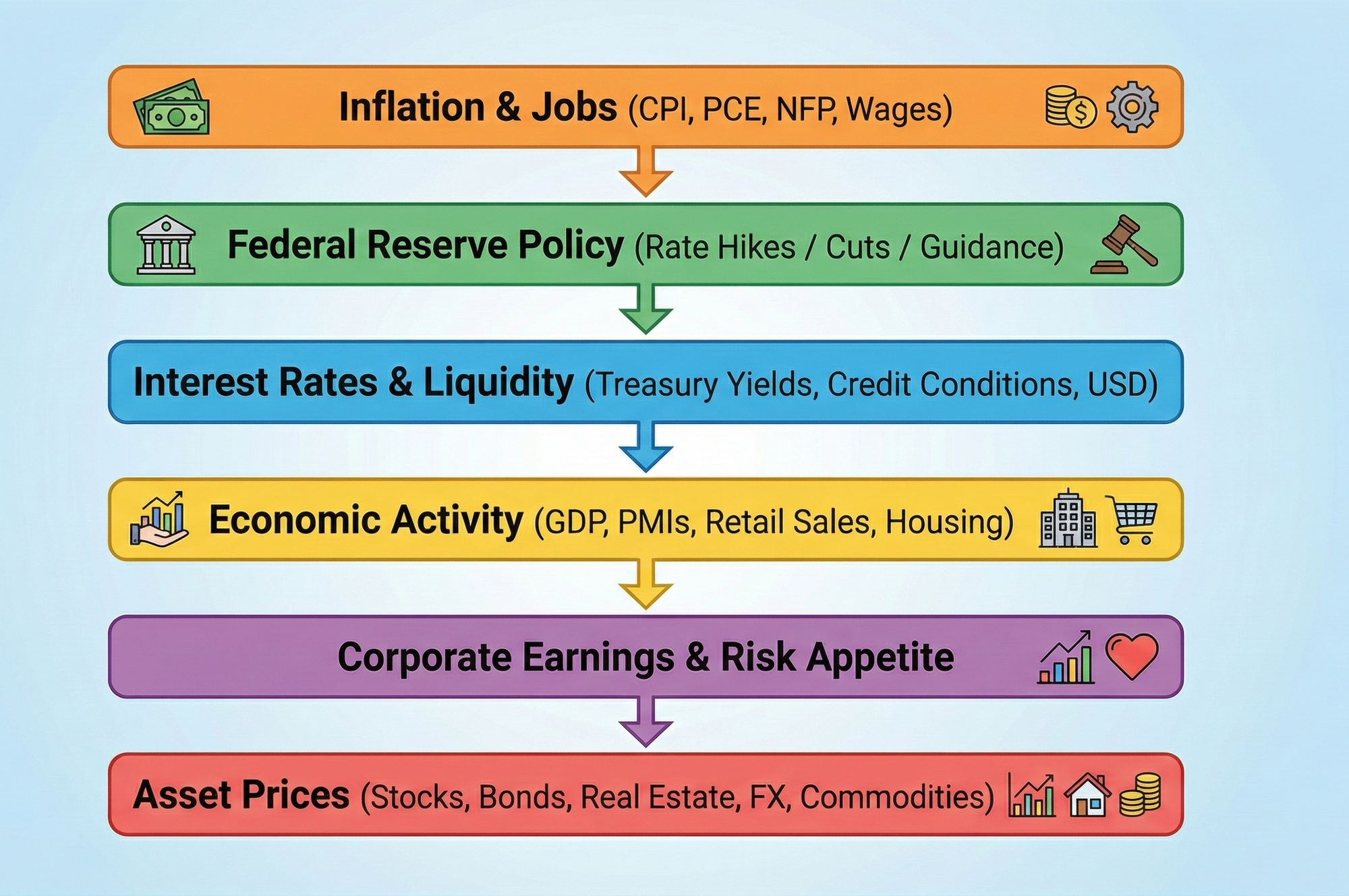

How Everything Links Together: The Economic Chain Reaction Investors Must Understand

For investors, individual economic data points rarely matter in isolation. Markets move based on how these indicators interact, reinforce each other, and ultimately influence monetary policy, earnings, and risk appetite.

Understanding this chain reaction helps investors anticipate moves before headlines hit.

Step 1: Inflation and Employment Drive Federal Reserve Policy

At the center of everything is the Federal Reserve’s dual mandate:

- Price stability (inflation)

- Maximum employment

That means:

- CPI, PCE, and PPI shape inflation expectations

- Nonfarm Payrolls, wage growth, and jobless claims define labor market strength

When inflation is rising and employment is strong, markets price in:

- Higher interest rates

- Tighter financial conditions

When inflation cools or the labor market weakens:

- Rate cuts or pauses come into focus

Investor takeaway:

Most market volatility starts with how new data changes Fed expectations, not the data itself.

Step 2: Fed Expectations Move Rates, Bonds, and the Dollar First

Before stocks react, markets usually reprice:

- Treasury yields (especially the 2-year)

- US dollar strength (DXY)

- Interest rate futures

This is why:

- Hot inflation → yields up, dollar up

- Weak data → yields down, dollar down

Investor takeaway:

Bond markets often call the equity move ahead of time.

Step 3: Interest Rates Influence Equities, Housing, and Credit

Interest rates act as gravity across markets:

- Higher rates

- Pressure growth stocks

- Slow housing activity

- Increase borrowing costs

- Compress valuation multiples

- Lower rates

- Support equities and risk assets

- Boost housing and refinancing

- Improve credit conditions

Housing data, retail sales, and PMIs then reflect these changes with a lag.

Investor takeaway:

Sectors respond differently depending on where rates are headed, not where they are today.

Step 4: Growth Data Confirms or Contradicts the Trend

Indicators like:

- GDP

- ISM Manufacturing & Services PMI

- Retail sales

Help investors answer one key question:

- Is the economy accelerating, slowing, or breaking?

This determines whether markets are in:

- Expansion

- Slowdown

- Recession risk

- Recovery

Investor takeaway:

PMIs often signal turning points before GDP confirms them.

Step 5: Markets Price the Future, Not the Present

By the time economic data looks good or bad in headlines:

- Markets may already be positioned for the next phase

That’s why:

- Stocks can rise during weak data (rate cuts expected)

- Stocks can fall on strong data (policy tightening feared)

Investor takeaway:

Always ask: Does this data change expectations?

If not, the market reaction may fade quickly.

The Big Picture for Investors

Think of the US economic system as a feedback loop:

Inflation & Jobs → Fed Policy → Rates & Liquidity → Growth & Earnings → Asset Prices

Successful investors don’t just track releases—they:

- Understand cause and effect

- Compare data against expectations

- Position portfolios based on where the cycle is heading

This integrated view is what turns economic noise into a strategic investment edge.