Cash Flow Forecasts in Financial Planning

You can be the most profitable business on paper, but without sufficient cash flowing in and out, you're on the fast track to trouble.

Cash flow forecasts for financial planning offer deeper insights into your future liquidity.

What is a Cash Flow Forecast?

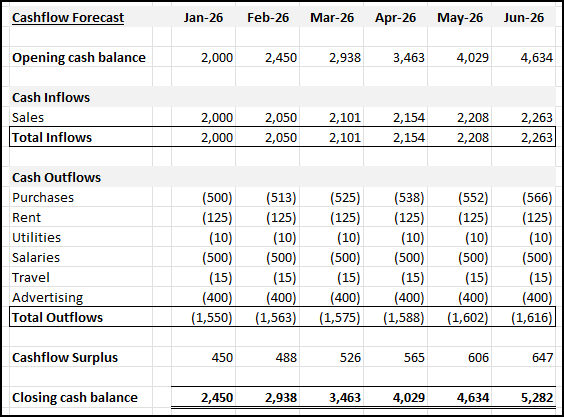

A cash flow forecast is an estimate of the cash you expect to receive (inflows) and the cash you expect to pay out (outflows) over a specific period. This could be weekly, monthly, quarterly, or even annually, depending on your business needs and the volatility of your cash movements.

Typical Cash Inflows include:

- Sales revenue (from cash sales or collections from debtors)

- Loan proceeds

- Asset sales

- Grants or investments

Typical Cash Outflows include:

- Payments to suppliers

- Salaries and wages

- Rent and utilities

- Loan repayments

- Tax payments

- Capital expenditures

By tracking these anticipated movements, you can project your opening and closing cash balances, identifying potential shortfalls or surpluses well in advance.

Why Are Cash Flow Forecasts Essential for Financial Planning?

The benefits of a robust cash flow forecast are immense:

- Early Warning System: It allows you to spot potential cash shortages before they become crises. This gives you time to take proactive measures, such as negotiating extended payment terms with suppliers, accelerating debtor collections, or securing short-term financing.

- Informed Decision-Making: Thinking about a new investment, hiring more staff, or expanding operations? Your cash flow forecast will tell you if your current and projected cash flow can support these decisions without putting your business at risk.

- Improved Budgeting: By understanding your future cash position, you can create more realistic and effective budgets, allocating resources where they're most needed and avoiding unnecessary spending.

- Strategic Growth: Identifying periods of surplus cash allows you to strategically plan for growth, whether that's reinvesting in the business, paying down debt, or building up a healthy cash reserve.

- Securing Funding: Lenders, investors, and even suppliers want to see that you have a firm grasp on your financial health. A well-prepared cash flow forecast is a cornerstone of any funding application, demonstrating your ability to manage your finances and repay obligations.

The Critical Role of Bank Covenants

This brings us to a crucial element often intertwined with external financing: bank covenants.

When you secure a loan from a bank, they don't just hope for the best. They'll typically include a set of conditions or promises in the loan agreement – these are your bank covenants. These covenants are designed to protect the bank's interests by ensuring your business remains financially stable and capable of repaying the loan.

Common types of bank covenants related to cash flow and financial health include:

- Debt Service Coverage Ratio (DSCR): This measures your business's ability to generate enough cash flow to cover its debt obligations. A common covenant might require your DSCR to be above a certain threshold (e.g., 1.25x), meaning your cash flow available for debt service must be at least 1.25 times your debt service payments.

- Current Ratio: This compares your current assets to your current liabilities, indicating your short-term liquidity. A covenant might require this ratio to be above 1.0 or 1.2, showing you have enough liquid assets to cover your immediate obligations.

- Debt-to-Equity Ratio (Gearing): This measures the proportion of debt financing relative to equity financing. A covenant might set an upper limit on this ratio to prevent your business from becoming over-leveraged.

- Minimum Cash Balance: Some covenants might stipulate that you maintain a certain minimum cash balance in your bank account.

Why are these important for your cash flow forecast?

Your cash flow forecast becomes a vital tool for monitoring and ensuring compliance with bank covenants. By projecting your future cash flows and financial ratios, you can:

- Proactively identify potential breaches: If your forecast shows you might dip below a minimum cash balance or fall short on your DSCR, you have time to address the issue before it becomes a formal breach.

- Communicate effectively with your bank: If you foresee a challenge, you can approach your bank with a revised forecast and a plan of action, demonstrating your proactivity and responsible management. This is far better than them discovering a breach after the fact.

- Avoid penalties: Breaching bank covenants can lead to serious consequences, including higher interest rates, additional fees, or even the immediate repayment of the loan. Your cash flow forecast helps you avoid these costly penalties.

Building Your Cash Flow Forecast

The most effective cash flow forecasts are tailored to your business. Here's a simplified approach:

- Start with your opening cash balance.

- List all anticipated cash inflows for the period (e.g., customer payments, loan disbursements). Be realistic and, if anything, conservative.

- List all anticipated cash outflows (e.g., supplier payments, payroll, rent, loan repayments, taxes). Be thorough and include all recurring and one-off expenses.

- Calculate your net cash flow (inflows less outflows) for each period.

- Add the net cash flow to your opening balance to get your closing cash balance for that period, which then becomes the opening balance for the next.

Regularly review and update the forecast as new information becomes available. The more accurate and up-to-date your forecast, the more valuable it will be.

The Bottom Line

A well-constructed and regularly updated cash flow forecast is a strategic planning tool.

It allows you to make informed financial decisions and maintain a healthy relationship with lenders by ensuring you remain compliant with bank covenants.