Delisting: Strategic Retreat from Public to Private

Companies often go public to raise capital, gain visibility, and offer liquidity to early investors.

However, there are times when the glare of the public spotlight can become a hindrance rather than a help. This is where the strategic decision to delist from public markets is considered - a move that allows companies to retreat to the private markets, often with the aim of unlocking long-term value.

Why Go Private?

Delisting, or going private, means a company's shares are no longer traded on a public stock exchange.

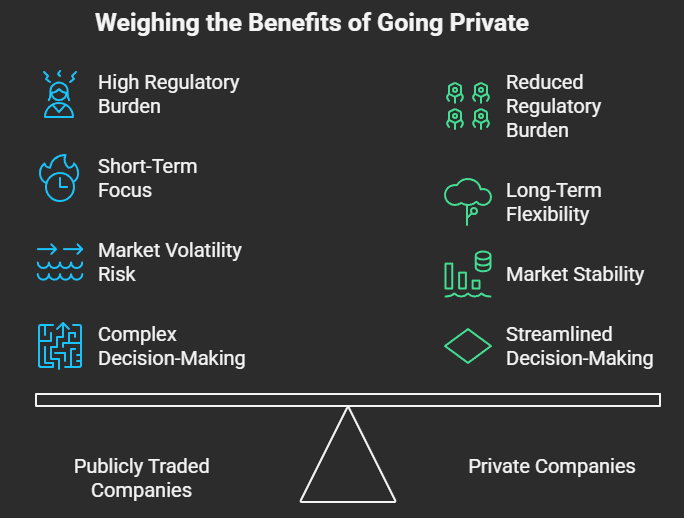

While it might seem counterintuitive for a company to forgo the benefits of public trading, there are several compelling reasons behind such a decision:

- Reduced Regulatory Burden and Costs: Publicly traded companies face stringent reporting requirements, compliance costs, and regulatory scrutiny. Going private significantly reduces these burdens, freeing up resources and management time.

- Greater Operational Flexibility: Public companies are often under immense pressure to deliver consistent quarterly earnings to satisfy a broad base of shareholders. This short-term focus can impede long-term strategic initiatives, especially those requiring significant investment without immediate returns. As a private entity, management can make decisions with a longer time horizon, free from market sentiment.

- Protection from Market Volatility and Hostile Takeovers: Public stock prices are susceptible to market fluctuations, economic conditions, and investor sentiment, which may not always reflect the company's true intrinsic value. Delisting insulates the company from this volatility and offers a stronger defense against unsolicited takeover bids.

- Streamlined Decision-Making: With a concentrated ownership structure, private companies can make decisions more swiftly and efficiently, without the need for extensive shareholder consultations and approvals.

- Perceived Undervaluation: This is a crucial driver for many privatization efforts. When a company's leadership believes the market is consistently undervaluing its shares, taking the company private allows them to buy back those shares at a discount and potentially realize the true value later.

The Mechanics of Going Private and the Control Premium

The process of delisting typically involves a tender offer to buy back shares from public shareholders. This offer often includes a control premium – an amount that a buyer is willing to pay over the current market price of a publicly traded company's shares in order to acquire a controlling interest.

This premium acknowledges the added value of being able to control the company's strategic direction, appoint management, and access its cash flows without the constraints of public ownership. Control premiums can vary widely but commonly range from 20% to 40% above the pre-announcement share price.

The offer usually requires a shareholder vote for approval and must comply with various regulatory requirements from bodies like the SEC. The offer is frequently initiated by the company's management (often with external financial partners), a majority shareholder, or a private equity firm looking to acquire and restructure the business away from public scrutiny.

Dell's Bold Move: A Case Study in Delisting

One of the most prominent examples of a company going private due to perceived undervaluation is Dell Inc. In 2013, founder Michael Dell, in partnership with private equity firm Silver Lake Partners, led a $24.4 billion buyout to take his company private.

At the time, Dell was struggling to adapt to a rapidly changing PC market. The company was battling declining sales, intense competition from new entrants in mobile and tablet computing, and a general shift in the tech landscape. Its stock price reflected this struggle, trading at levels that Michael Dell believed did not accurately represent the company's underlying value or its potential for future transformation.

Michael Dell argued that the company needed to undertake significant restructuring, diversify its product offerings (moving beyond just PCs into enterprise solutions and services), and make long-term investments that would likely depress short-term earnings. Such a transformation, he believed, would be exceedingly difficult and met with skepticism by public markets focused on quarterly results. By going private, Dell gained the freedom to:

- Focus on long-term strategy: Without the pressure of public earnings calls, Dell could invest in R&D, acquire new businesses, and reshape its business model without immediate investor backlash.

- Avoid short-term market scrutiny: The company could make tough decisions, like streamlining operations or exiting less profitable segments, without worrying about immediate stock price drops.

- Realign interests: Michael Dell believed that a private structure would better align the interests of management with the long-term success of the company, rather than being dictated by the whims of public shareholders.

The success of this transformation was evident when Dell Technologies later re-listed on the NYSE in 2018, showcasing that going private can be a powerful, albeit temporary, strategic maneuver that ultimately paid off.

The Flip Side: Disadvantages of Delisting

While the benefits can be substantial, delisting isn't without its drawbacks:

- Loss of Access to Public Capital: The most significant disadvantage is losing the ability to raise capital easily through public stock offerings. This can limit expansion plans and necessitate reliance on more expensive private funding.

- Reduced Liquidity for Shareholders: Shareholders will find it harder to sell their shares after a delisting, as trading moves to less liquid over-the-counter (OTC) markets.

- Impact on Market Perception: A voluntary delisting can sometimes be viewed negatively by the market, potentially signaling financial instability or governance issues, even if the strategic reasons are sound.

- Loss of Public Visibility and Prestige: Being publicly listed often brings a certain level of brand recognition and prestige, which can be lost upon delisting.

Conclusion: A Calculated Risk

For companies contemplating a retreat from public markets, the decision to delist is a complex one, requiring careful consideration of both the potential advantages and disadvantages.

As Dell's journey illustrates, it can be a powerful strategic tool for companies that believe their true value is not being recognized by the public markets, allowing them to pursue long-term growth and transformation away from the pressures of quarterly reporting.

While it sacrifices the ease of public capital, it can offer the freedom and flexibility needed to reinvent and ultimately thrive.