Introduction to Options Terminology

Options trading can seem like a foreign language at first. Puts, calls, strike prices, expiration dates. But just like learning any new skill, mastering the basics is the first step.

This guide will break down the most essential terms you need to know.

The Absolute Basics: What is an Option?

An option is a financial contract that gives the buyer the right, but not the obligation, to buy or sell an underlying asset (like a stock or ETF) at a predetermined price on or before a specific date.

For this right, the buyer pays a premium to the seller (also known as the writer) of the option.

The Two Main Types of Options

- Call Option (CALL):

- Gives the holder the right to buy the underlying asset at a specified price.

- Buyers of calls are typically bullish, expecting the underlying asset's price to go up.

- Sellers (writers) of calls are typically bearish or neutral, expecting the price to stay flat or go down, or willing to sell shares they own at the strike price.

- Put Option (PUT):

- Gives the holder the right to sell the underlying asset at a specified price.

- Buyers of puts are typically bearish, expecting the underlying asset's price to go down.

- Sellers (writers) of puts are typically bullish or neutral, expecting the price to stay flat or go up, or willing to buy shares they don't own at the strike price.

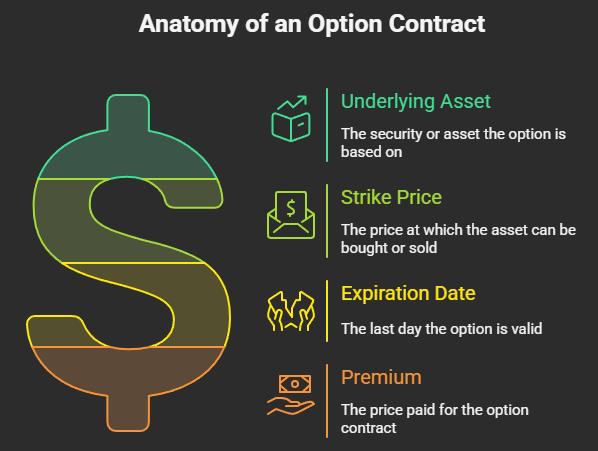

Key Components of Every Option Contract

- Underlying Asset:

- The security or asset on which the option is based. This could be a stock (e.g., Apple, Tesla), an Exchange Traded Fund (ETF) (e.g., SPY, QQQ), or even commodities.

- Strike Price (Exercise Price):

- The predetermined price at which the underlying asset can be bought (for a call) or sold (for a put) if the option is exercised.

- Example: A call option with a strike price of $150 on Apple means you can buy Apple stock at $150, regardless of its market price.

- Expiration Date:

- The last day on which the option contract is valid and can be exercised. After this date, the option expires worthless if not exercised or closed.

- Options can have weekly, monthly, quarterly, or even LEAPS (Long-term Equity Anticipation Securities) expirations, which can be years away.

- Premium:

- The price of the option contract. This is what the buyer pays to the seller for the rights granted by the option.

- The premium is quoted per share (e.g., $2.50), but since one options contract typically controls 100 shares, the total cost would be $2.50 x 100 = $250.

Understanding the Moneyness of an Option

This describes the relationship between the underlying asset's current price and the option's strike price.

- In-the-Money (ITM):

- Call: Underlying price is above the strike price. (You can buy cheaper than market price).

- Put: Underlying price is below the strike price. (You can sell higher than market price).

- ITM options have intrinsic value.

- At-the-Money (ATM):

- Underlying price is equal to or very close to the strike price.

- ATM options have little to no intrinsic value, primarily time value.

- Out-of-the-Money (OTM):

- Call: Underlying price is below the strike price. (It would be cheaper to buy on the open market).

- Put: Underlying price is above the strike price. (It would be cheaper to sell on the open market).

- OTM options have no intrinsic value, only time value. They expire worthless if they don't move ITM by expiration.

Key Players in Options Trading

- Holder (Buyer):

- The person who buys the option. They pay the premium and have the right to exercise.

- Writer (Seller):

- The person who sells the option. They receive the premium and have the obligation to fulfill the contract if exercised.

Crucial Concepts

- Intrinsic Value:

- The immediate profit you'd make if you exercised the option right now.

- For a call: Current Stock Price - Strike Price (if positive).

- For a put: Strike Price - Current Stock Price (if positive).

- OTM options have no intrinsic value.

- Time Value (Extrinsic Value):

- The portion of an option's premium that is not intrinsic value. It represents the value attributed to the time remaining until expiration and the volatility of the underlying asset.

- Time value erodes as the option approaches expiration (this is known as Theta Decay).

- Longer-dated options generally have more time value.

- Implied Volatility (IV):

- A crucial concept derived from the option's market price. It represents the market's expectation of how much the underlying asset's price will fluctuate (its volatility) between now and the option's expiration date.

- High IV suggests the market expects significant price swings, leading to higher option premiums.

- Low IV suggests the market expects less price movement, leading to lower option premiums.

- IV is forward-looking and changes constantly based on market sentiment, news, and events. It's distinct from historical volatility, which measures past price movements.

- Traders often use IV to gauge whether options are expensive or cheap relative to their historical volatility.

- Bid and Ask:

- Bid: The highest price a buyer is willing to pay for an option.

- Ask (Offer): The lowest price a seller is willing to accept for an option.

- The difference between the bid and ask is the spread.

- Open Interest:

- The total number of options contracts that are currently outstanding (not yet closed or expired) for a particular strike price and expiration date.

- High open interest can indicate liquidity and strong market interest.

- Volume:

- The number of options contracts traded for a particular strike price and expiration date within a specific trading period (e.g., a day).

- High volume indicates active trading.

The Greeks

You'll often hear about the Greeks in options trading. These are measures of an option's sensitivity to various factors:

- Delta: Measures how much an option's price is expected to move for every $1 change in the underlying asset's price.

- Gamma: Measures the rate of change of Delta.

- Theta: Measures how much an option's price erodes each day due to the passage of time (time decay).

- Vega: Measures an option's sensitivity to changes in implied volatility.

- Rho: Measures an option's sensitivity to changes in interest rates.

Study

This list covers the foundational terms you'll encounter when exploring options. Options trading involves complex strategies and significant risk.

The more you understand the language, the better equipped you'll be to make informed decisions in the world of options.