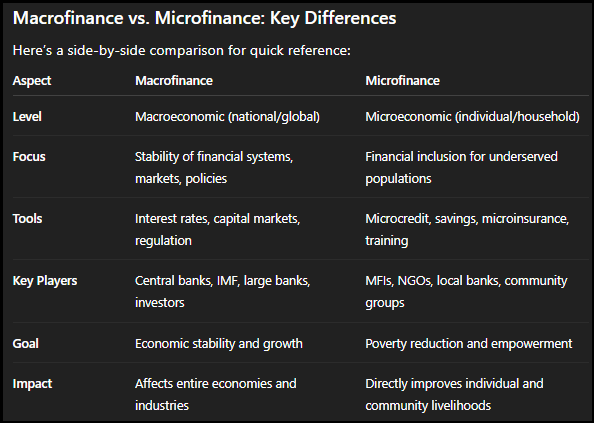

Macrofinance vs. Microfinance: Key Differences, Examples, and Why They Matter

Think of macrofinance and microfinance as two ends of a telescope: one offering a panoramic view of the global financial system, the other zooming in on individual financial interactions.

Both are essential to understanding how money shapes economies, businesses, and people’s lives.

In this guide, we’ll explore the differences between macrofinance and microfinance, define each term, highlight real-world examples, and explain why they matter in today’s economy.

What is Macrofinance? The Big Picture Perspective

Macrofinance operates at the macroeconomic level, focusing on the overall health and structure of a financial system. It looks at broad economic trends, large-scale institutions, and the relationship between financial markets and key economic indicators such as GDP, inflation, and employment.

Key characteristics of Macrofinance

- Financial System Stability: Ensures smooth functioning of banks, stock markets, and institutions while preventing crises.

- Monetary & Fiscal Policy: Studies how interest rates, money supply, and government spending affect economic growth.

- Capital Markets: Analyzes stock exchanges, bond markets, and derivatives that drive corporate and government financing.

- International Finance: Tracks cross-border capital flows, exchange rates, and global financial interconnectedness.

- Regulation & Supervision: Assesses government and international regulations for maintaining financial safety and trust.

Key Players in Macrofinance

- Central banks (Federal Reserve, European Central Bank)

- Large commercial and investment banks

- Institutional investors (pension funds, hedge funds)

- International organizations (IMF, World Bank)

Why Macrofinance Matters

Macrofinance helps:

- Policymakers stabilize economies during booms and busts

- Investors track global market trends

- Businesses make strategic decisions based on forecasts

What is Microfinance? Empowering at the Grassroots Level

Microfinance works at the microeconomic level, delivering financial services to individuals and small businesses who are excluded from traditional banking. It plays a critical role in financial inclusion, especially in developing economies.

Key characteristics of Microfinance

- Financial Inclusion: Provides access to banking for the unbanked and underbanked.

- Microcredit (Small Loans): Funds small businesses, farms, and local entrepreneurs.

- Savings Services: Encourages safe and accessible saving mechanisms.

- Microinsurance: Protects low-income individuals against risks like illness or crop failure.

- Remittance Services: Facilitates safe money transfers from migrant workers.

- Financial Literacy: Offers training to improve money management and decision-making.

Key Players in Microfinance

- Microfinance institutions (MFIs)

- NGOs and community organizations

- Commercial banks with microfinance divisions

Why Microfinance Matters

Microfinance empowers individuals and communities to:

- Start or expand small businesses

- Invest in education and healthcare

- Build financial resilience

- Break cycles of poverty through sustainable livelihoods

Interconnectedness Between Macrofinance and Microfinance

Though distinct, macrofinance and microfinance are deeply connected:

- A stable macrofinancial environment (low inflation, stable interest rates) creates fertile ground for microfinance initiatives to thrive.

- Successful microfinance programs boost economic participation, reduce poverty, and ultimately contribute to macro-level growth.

Example: A growing class of small entrepreneurs supported by microfinance can drive higher GDP, increase tax revenues, and strengthen national economies.

Example: CFO of a Global Automotive Manufacturer

To see macrofinance in action, consider the Chief Financial Officer (CFO) of a global car company:

- Currency Risk Management – Hedging against exchange rate fluctuations. The CFO would implement hedging strategies (e.g., using forward contracts or options) to mitigate these risks and ensure predictable costs and revenues across different regions.

- Interest Rate Analysis – Adjusting debt financing and investment plans based on borrowing costs.

- Commodity Price Volatility – Managing steel, aluminum, and rare-earth supply risks. The CFO tracks these macro trends closely, using commodity futures to lock in prices, or seeking alternative suppliers to de-risk the supply chain.

- Economic Growth Tracking – Adjusting production based on consumer confidence and GDP trends. A slowdown in a major economy might signal reduced demand for vehicles, leading them to adjust production volumes, marketing spend, and inventory levels.

- Regulatory Compliance – Navigating international tax laws and trade policies.

- Capital Allocation – Deciding factory expansions in different countries based on global financial conditions.

FAQs About Macrofinance vs. Microfinance

Q: What is the main difference between macrofinance and microfinance?

A: Macrofinance looks at national and global financial systems, while microfinance focuses on individuals and small businesses excluded from traditional banking.

Q: How does microfinance reduce poverty?

A: By giving low-income individuals access to credit, savings, and insurance, microfinance helps them start businesses, manage risks, and improve education and healthcare access.

Q: Why is macrofinance important?

A: It ensures economic stability, prevents financial crises, and helps governments and businesses make informed financial decisions.

Q: Can microfinance impact macrofinance?

A: Yes. Widespread financial inclusion strengthens economies, increases consumer spending, and contributes to GDP growth.

Conclusion

Macrofinance vs. microfinance illustrates two powerful but complementary approaches to finance.

Macrofinance safeguards the global economy, while microfinance empowers individuals and communities.

Understanding both perspectives helps us see how global markets connect with local realities - from central banks influencing monetary policy to a farmer receiving a small loan to grow crops. Together, they shape a more stable and inclusive financial world.