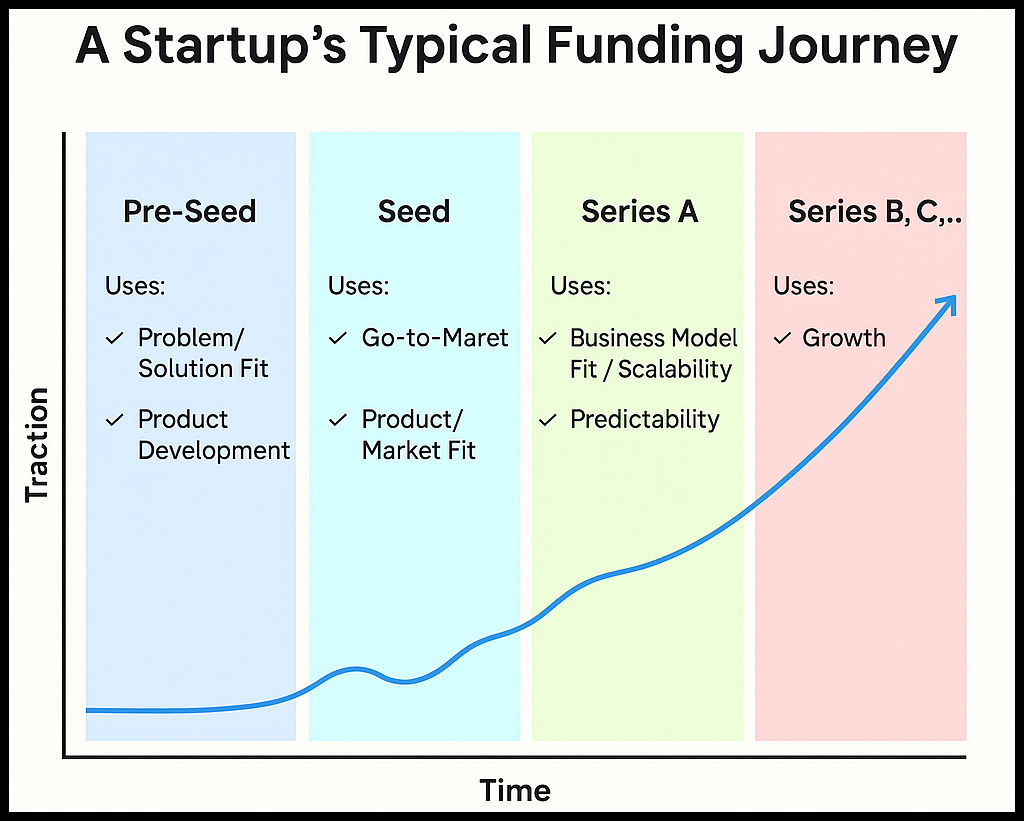

Navigating the Startup Funding Rounds

The journey of a startup is punctuated by distinct funding rounds, each serving a unique purpose and attracting different types of investors.

Let's break down the typical funding journey:

1. Pre-Seed Funding: The Genesis

This is the very first injection of capital, often before a formal company structure or even a fully fleshed-out product. Think of it as the initial fuel to get the engine sputtering.

- Purpose: Primarily used for validating the core idea, market research, building a bare-bones prototype (Minimum Viable Product - MVP), and assembling the initial founding team. It's about proving the concept can work.

- Typical Amount: Highly variable, often ranging from a few thousand dollars to a few hundred thousand. Some can reach up to $5 million, especially for experienced founders with strong networks.

- Sources:

- Founders' personal savings (Bootstrapping): The most common starting point.

- Friends and Family: Often the first believers in the idea, willing to take a significant risk.

- Angel Investors: High-net-worth individuals who invest their own money in early-stage companies, often providing mentorship and connections.

- Accelerators and Incubators: Programs that offer mentorship, resources, and a small amount of capital in exchange for equity.

- Micro VCs: Smaller venture capital funds focusing exclusively on very early-stage investments.

- What Investors Look For: A compelling idea, a passionate and capable founding team, a clearly identified market opportunity, and a strong vision. They are betting heavily on the people and the potential.

- Equity Dilution: Founders typically give up a small percentage of equity at this stage, but the valuation is modest due to the high risk.

2. Seed Funding: Planting the Seeds of Growth

Once the idea has some validation and a basic product is in development, seed funding helps to plant the seeds for more substantial growth.

- Purpose: To refine the MVP, acquire early customers, build out the initial team, conduct further market validation, and establish a clear roadmap for scalability and profitability. It's about proving product-market fit.

- Typical Amount: Generally ranges from $500,000 to $5 million, though this can vary widely.

- Sources:

- Angel Investors: Continue to be a significant source.

- Seed-stage Venture Capital (VC) firms: VC firms specifically focused on early-stage investments.

- Crowdfunding: Platforms that allow a large number of individuals to invest smaller amounts (equity crowdfunding).

- Syndicates: Groups of angel investors or VCs who pool their money for a single investment.

- What Investors Look For: Evidence of product-market fit (e.g., early user adoption, positive feedback), a developing business model, a strong team, and a clear vision for growth.

- Equity Dilution: Founders can expect to give up 10% to 25% of the company in a seed round. While this seems significant, the goal is to grow the pie significantly.

- Key Metrics: Early customer acquisition costs (CAC), lifetime value (LTV) of customers, user engagement, and a clear path to generating revenue.

3. Series A Funding: Optimizing for Scale

Series A is typically the first major institutional funding round from venture capital firms. At this stage, the company has demonstrated product-market fit and is ready to optimize its operations for scalable growth.

- Purpose: To refine the business model, acquire more customers at scale, expand the team (especially in sales, marketing, and engineering), and invest in further product development. It's about proving a repeatable and scalable business model.

- Typical Amount: Usually ranges from $2 million to $15 million, but can go higher in high-growth sectors.

- Sources:

- Venture Capital (VC) firms: These firms lead Series A rounds, bringing significant capital and strategic guidance.

- Some Angel Investors: Particularly those who participated in the seed round and want to continue their investment.

- What Investors Look For: Strong growth metrics (e.g., consistent revenue growth, user acquisition rates), a clear and defensible market position, a well-defined go-to-market strategy, and a highly capable management team. They are looking for clear signs of a scalable business.

- Equity Dilution: Founders typically give up another 15% to 25% of equity in a Series A round.

- Key Metrics: Customer acquisition cost (CAC), customer lifetime value (LTV), monthly recurring revenue (MRR) for SaaS businesses, churn rate, and scalability of the business model.

4. Series B Funding: Accelerating Growth

With a proven and scalable business model, Series B funding is about accelerating growth, expanding market reach, and potentially entering new markets.

- Purpose: To scale operations significantly, expand into new geographical markets, enhance product offerings, make strategic hires for leadership positions, and potentially explore strategic partnerships or acquisitions.

- Typical Amount: Generally ranges from $10 million to $30 million, but can be much larger depending on the industry and growth trajectory.

- Sources:

- Venture Capital (VC) firms: Often includes existing Series A investors and new, larger VC firms.

- Corporate Venture Capital funds: Investment arms of large corporations.

- Family Offices: Private wealth management advisory firms.

- What Investors Look For: Continued strong growth, evidence of market leadership, a clear path to profitability, and the ability to execute on aggressive expansion plans. They want to see a commercially viable product or service ready to dominate its market.

- Equity Dilution: Dilution typically ranges from 10% to 20% in a Series B round.

- Key Metrics: Market share, revenue growth, profitability metrics, operational efficiency, and competitive advantage.

5. Series C Funding and Beyond: Market Dominance and Exit Preparation

By Series C, a company is typically well-established, has a substantial market presence, and is looking to solidify its leadership or prepare for a major liquidity event (like an IPO or acquisition). These rounds can continue through Series D, E, F, and so on, depending on the company's needs and ambitions.

- Purpose: To achieve significant market dominance, expand globally, diversify product lines, make large-scale acquisitions, or prepare for an Initial Public Offering (IPO) or a strategic acquisition.

- Typical Amount: Can range from tens of millions to hundreds of millions of dollars, or even more.

- Sources:

- Late-stage Venture Capital (VC) firms: VCs specializing in more mature companies.

- Private Equity (PE) firms: Investors who typically focus on acquiring and growing mature companies.

- Hedge Funds: Investment funds that use a variety of strategies to generate high returns.

- Investment Banks: Facilitate large funding rounds and prepare companies for public offerings.

- Corporate Investors: Strategic investments from large corporations.

- What Investors Look For: Sustained hyper-growth, clear market leadership, a strong and diversified revenue stream, operational excellence, and a credible path to a lucrative exit. They want to see a robust business ready for the next big step.

- Equity Dilution: Dilution per round tends to decrease in later stages, often ranging from 5% to 15%, as the company's valuation is significantly higher. However, the cumulative effect of multiple rounds can still be substantial.

- Key Metrics: Market share, global reach, sustained profitability, potential for significant returns on investment, and readiness for public markets or acquisition.

Understanding Equity Dilution

A common concern for founders throughout these funding rounds is equity dilution. Each time a company issues new shares to investors in exchange for capital, the ownership percentage of existing shareholders decreases.

While this can sound negative, it's often a necessary and strategic trade-off. As the pie (company's valuation) grows significantly with each successful funding round, a smaller percentage of a much larger pie is often far more valuable than a larger percentage of a small, struggling one. Strategic dilution, when managed effectively, fuels growth and ultimately creates more value for all shareholders.

The Investor Mindset Shift

It's important to note how the investor's perspective changes with each stage:

- Pre-Seed/Seed: Investors are primarily betting on the team and the idea. The risk is high, but the potential return is also highest.

- Series A: Investors look for product-market fit and a scalable business model. They want to see early traction and a clear plan for growth.

- Series B: Investors seek proven growth, market leadership potential, and the ability to scale operations efficiently.

- Series C and Beyond: Investors are focused on market dominance, strong financials, and a clear path to a major exit.

Conclusion

The journey from a nascent idea to a market-leading company is a testament to perseverance, innovation, and strategic capital allocation. Understanding the nuances of pre-seed, seed, Series A, Series B, Series C, and subsequent funding rounds empowers entrepreneurs to navigate the world of venture capital, securing the resources needed to fuel their growth.

For investors, it offers a roadmap to identifying and backing companies at different stages of their growth, aiming for substantial returns.