Finance Career Progression: Roles in a Financial Organization Explained

If you’re considering a career in finance, it’s important to understand the hierarchy of roles within a financial organization.

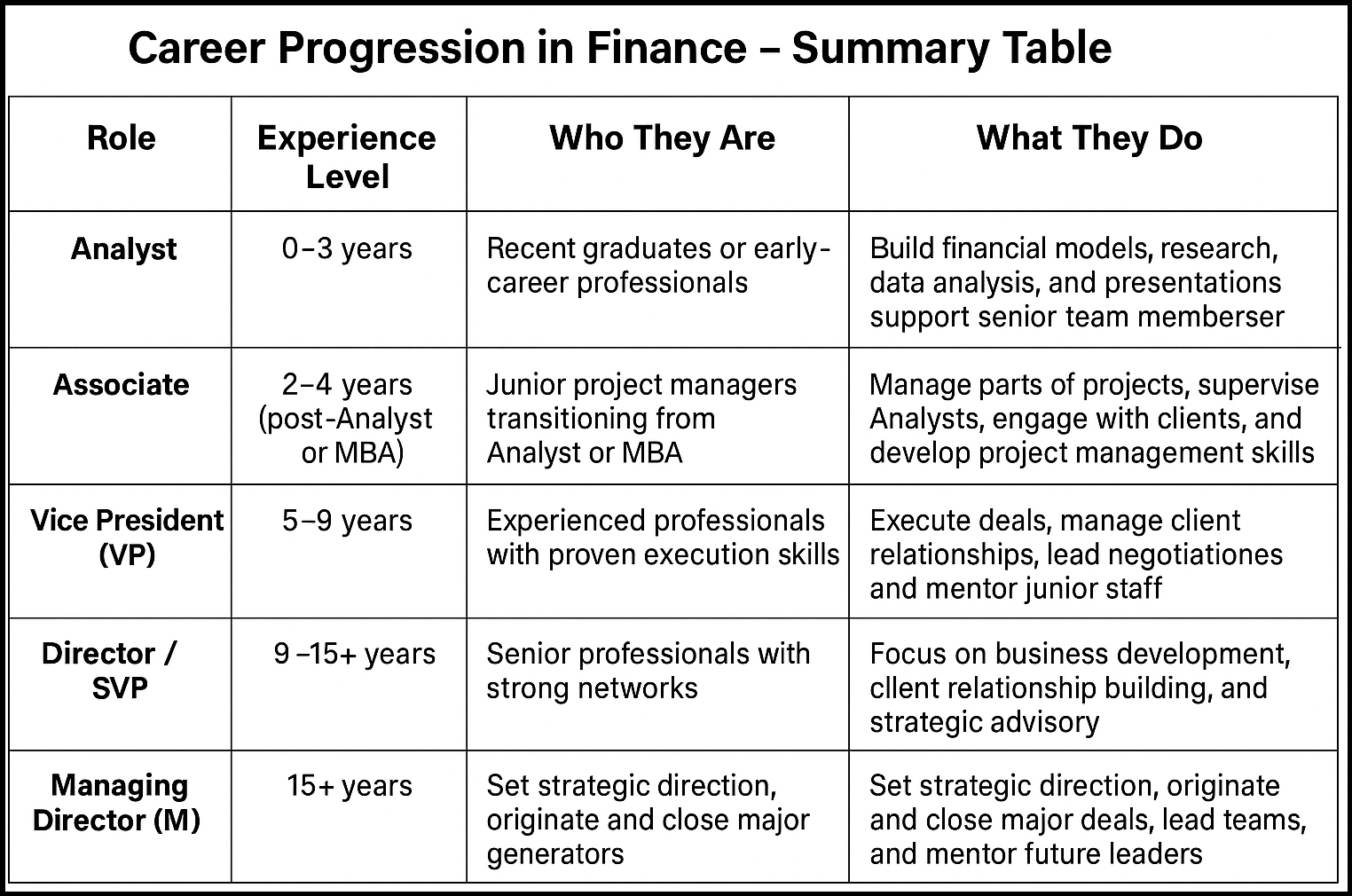

From the entry-level Analyst to the prestigious Managing Director, each step on the ladder comes with new responsibilities, skills, and opportunities.

This guide breaks down the typical finance career progression so you can see what it takes to move up in the industry.

Analyst Role in Finance (Entry-Level)

Who they are: Analysts are typically recent graduates or professionals with 1–3 years of experience. This is the starting point for most finance careers.

What they do: Analysts prepare financial models, conduct research, create presentations, and perform data analysis. They provide the foundation for decision-making and support more senior team members.

Skills needed:

- Strong Excel and financial modeling skills

- Attention to detail

- Ability to work long hours under pressure

- Clear communication and presentation skills

Career Tip: Analysts who demonstrate accuracy, reliability, and initiative often get fast-tracked for promotion to Associate.

Associate Role in Finance

Who they are: After 2–4 years as an Analyst—or sometimes directly after an MBA—professionals move into the Associate role.

What they do: Associates manage portions of projects and oversee Analysts. They interact with clients, handle due diligence, and help execute deals. Associates serve as the bridge between detailed analysis and strategic oversight.

Skills needed:

- Project management

- Client communication

- Advanced technical and financial modeling expertise

- Leadership and mentoring abilities

Career Tip: At this stage, focus on building your professional network and developing leadership skills.

Vice President in Finance: Key Responsibilities

Who they are: With 5–9 years of experience, Vice Presidents (VPs) are proven professionals who can lead deals and client relationships.

What they do: VPs are execution experts, often serving as the day-to-day client contact. They lead negotiations, ensure smooth deal progress, and mentor junior staff. VPs are also critical in training Analysts and Associates.

Skills needed:

- Negotiation and leadership

- Relationship management

- Deal execution expertise

- Ability to manage multiple teams and priorities

Career Tip: VPs should focus on sharpening client relationship skills while building a reputation for reliability and expertise.

Director / Senior Vice President (SVP) Role in Finance

Who they are: Directors or SVPs usually have 9–15+ years of experience. They’ve developed deep industry expertise and a strong client network.

What they do: Directors balance execution with business development. They originate new business, strengthen long-term partnerships, and guide strategy. Their role is more outward-facing, focusing on generating revenue and advising clients.

Skills needed:

- Strategic business development

- High-level client advisory skills

- Industry specialization

- Leadership in originating deals

Career Tip: Directors who excel at originating business set themselves up for promotion to Managing Director.

Managing Director in Finance: The Rainmaker

Who they are: Managing Directors (MDs) are at the top of the finance career ladder, often with 15+ years of experience and a track record of bringing in significant business.

What they do: MDs set strategic direction, lead entire teams, and generate substantial revenue. They are responsible for securing major deals, maintaining top client relationships, and representing the firm at the highest level.

Skills needed:

- Visionary leadership

- Extensive client network

- High-level strategic thinking

- Ability to consistently generate revenue

Career Tip: To become an MD, professionals need not just technical expertise but the ability to act as a firm-wide leader and rainmaker.

The Interplay of Roles in a Financial Organization

While each role has distinct responsibilities, the success of a financial organization depends on seamless collaboration.

Analysts provide data, Associates refine strategy, VPs execute deals, Directors originate business, and MDs lead the firm.

Together, they form a well-oiled machine that drives growth and client success.

Final Thoughts

Climbing the finance career ladder is challenging but rewarding. Each stage offers new opportunities to develop skills, build relationships, and make a greater impact.

Whether you’re just starting as an Analyst or aiming for the Managing Director seat, understanding the progression helps you chart your path with purpose.