Unlevered vs. Levered Free Cash Flow: DCF

Unlevered Free Cash Flow (UFCF)

UFCF is the cash flow generated from core business operations, before considering any debt payments. It's a measure of the company's intrinsic profitability, independent of its capital structure.

How is it calculated?

A common way to calculate UFCF is:

- EBIT (Earnings Before Interest & Taxes)

- Minus Taxes on EBIT (or EBIT * (1 - Tax Rate))

- Plus Depreciation & Amortization

- Minus Capital Expenditures (CapEx)

- Minus / Plus Changes in Net Working Capital (NWC)

Why is it unlevered? We start with EBIT (before interest expenses). This means we are looking at the cash flow available to all capital providers – both debt and equity. It's a debt-free measure of cash flow from operations.

What is being valued? The value of core business operations to all investors/sources of capital. The Enterprise Value.

Relevant Discount Factor: Weighted Average Cost of Capital (WACC).

Levered Free Cash Flow (LFCF)

LFCF is the cash flow remaining after all debt obligations have been met. It's the cash flow specifically available to the equity holders of the company.

How is it calculated?

A common way to calculate LFCF is:

- Cash Flow from Operating Activities (which is after non-cash expenses)

- Minus Capital Expenditures (CapEx)

- Minus Debt Principal Repayment

Why is it levered? Because Net Income is used, interest expense has already been deducted, meaning the cash flow available to equity holders is presented after debt service.

What is being valued? The value of the business to equity investors after satisfying debt obligations. The Equity Value.

Relevant Discount Factor: Cost of Equity (CAPM).

Impact on DCF Valuation

The type of free cash flow you use dictates which discount rate you apply and, consequently, which value you derive.

1. Unlevered Free Cash Flow (UFCF) and the WACC

When you use Unlevered Free Cash Flow (UFCF) in a DCF, you are valuing the entire company (the enterprise value), as if it were financed entirely by equity. Since UFCF represents the cash flow available to all capital providers, you must discount it by a rate that reflects the cost of all capital. This rate is the Weighted Average Cost of Capital (WACC).

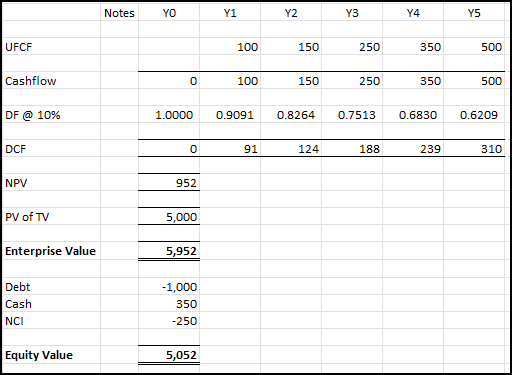

UFCF DCF (Enterprise Value):

Once you arrive at an Enterprise Value, you then subtract Net Debt to get to the Equity Value.

2. Levered Free Cash Flow (LFCF) and the Cost of Equity

When you use Levered Free Cash Flow (LFCF) in a DCF, you are directly valuing the equity of the company. Since LFCF represents the cash flow available only to equity holders (after debt obligations), you must discount it by the rate that reflects the cost of equity capital. This rate is the Cost of Equity (Ke), typically derived from the Capital Asset Pricing Model (CAPM).

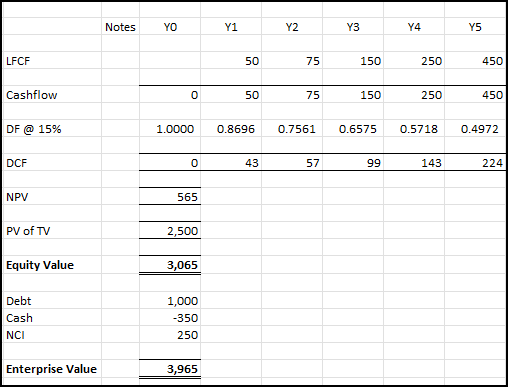

LFCF DCF (Equity Value):

Once you arrive at an Equity Value, you then add Net Debt to get to the Enterprise Value.

Enterprise Value (EV)

Enterprise Value is considered the total value of a company, representing the market value of its operating assets. It's the theoretical price an acquirer would pay for the entire business, including its debt, but also taking into account any cash on its balance sheet.

It's capital structure neutral because it reflects the value of the business's operations before considering how those operations are financed (i.e., by debt or equity). This is why a UFCF DCF directly calculates Enterprise Value.

EV = Equity Value + Total Debt + Value of Preferred Stock + Value of Non-Controlling Interests - Excess Cash and Non-core Assets

The value of the company's core business assets (i.e., excludes non-core assets) but to all investors (including equity, debt, preferred and potentially non-controlling interests).

Equity Value

Equity Value is the value of the company that belongs only to the shareholders. It represents the value of the common stock. This is what you would get if you multiplied the current share price by the number of outstanding shares.

An LFCF DCF directly calculates Equity Value because it focuses on the cash flow available after all debt obligations have been met.

Equity Value = Price per Share * Fully Diluted Shares Outstanding

The value of all company assets (core and non-core) but only to equity investors (common shareholders).

Key Takeaways and When to Use Which

- UFCF is the standard for most DCF analyses. It allows for comparison of companies with different capital structures and provides an enterprise value.

- LFCF is less common for full DCF models but can be useful for specific purposes. It's a direct route to equity value, but it implicitly bakes in the current capital structure. This means if the company's debt levels or interest rates are expected to change significantly, using LFCF can be less robust.

- Consistency is paramount. If you use UFCF, you must use WACC. If you use LFCF, you must use the Cost of Equity.

Understanding the difference between unlevered and levered free cash flow is a practical necessity for building accurate and insightful financial models.